Issues for housing market as banks tighten credit

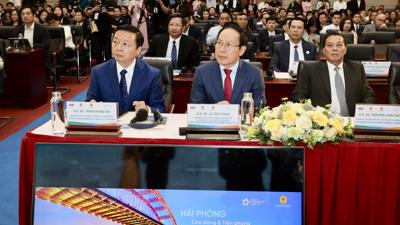

Conference attendees discuss the real estate market and offer their opinion as banks tighten credit for real estate business.

At a recent conference on the real estate market, Prime Minister Pham Minh Chinh emphasized the importance of developing a safe, healthy, and sustainable real estate ecosystem. He also directed the State Bank of Vietnam (SBV) to supervise, control, and restructure real estate credit to ensure its proper use and avoid risks to the market with flexible and effective management.

Discussing the role of credit institutions in participating in the real estate market, SBV Governor Nguyen Thi Hong said that under existing regulations, credit institutions have the role of lending to real estate market participants, directly buying bonds from real estate businesses, providing guarantees for market players, and in some cases directly buying and holding real estate.

If credit institutions cannot find a balance between deposits and lending, they may face liquidity risks and fail to meet demand for deposit repayments.

According to Mr. Nguyen Quoc Hung, General Secretary of the Vietnam Banks Association, the SBV’s strict control over real estate credit is a solution to limit speculation and help the market become transparent and avoid a real estate bubble. This is necessary to make the market healthy and reduce risks to the economy, especially in the context of the boom in the market in recent times, with most investors using credit.

However, according to Dr. Su Ngoc Khuong, Senior Director of Savills Vietnam’s Investment Department, in the context of banks reviewing their lending capabilities to real estate, if macro policies such as fiscal and monetary policies change and projects’ legal problems are resolved, the market will see more positive signs.

He added that the real estate market will not change a great deal compared to the past seven months, when supply has been limited and banks have tightened credit, and prices will increase 20-30 per cent compared to previous years. In the long term, over the next 3-5 years, major cities will gradually lose their appeal and competitiveness compared to neighboring areas.