Vietnam has been increasingly recognized in recent years as one of the most dynamic emerging countries in the fields of innovation and startups. Figures from the Ministry of Science and Technology (MoST) show that, by the end of 2024, Vietnam’s startup ecosystem had grown to over 4,000 startups, including two unicorns and eleven endeavors valued at over $100 million.

The ecosystem also includes more than 1,400 startup support organizations, 202 co-working spaces, 208 venture capital funds, 35 business accelerators, 79 incubators, and approximately 170 universities and colleges engaged in innovative startup activities. More than 20 innovation and startup centers have also been established at both the local and national levels.

SOLID BASE FOR INNOVATION

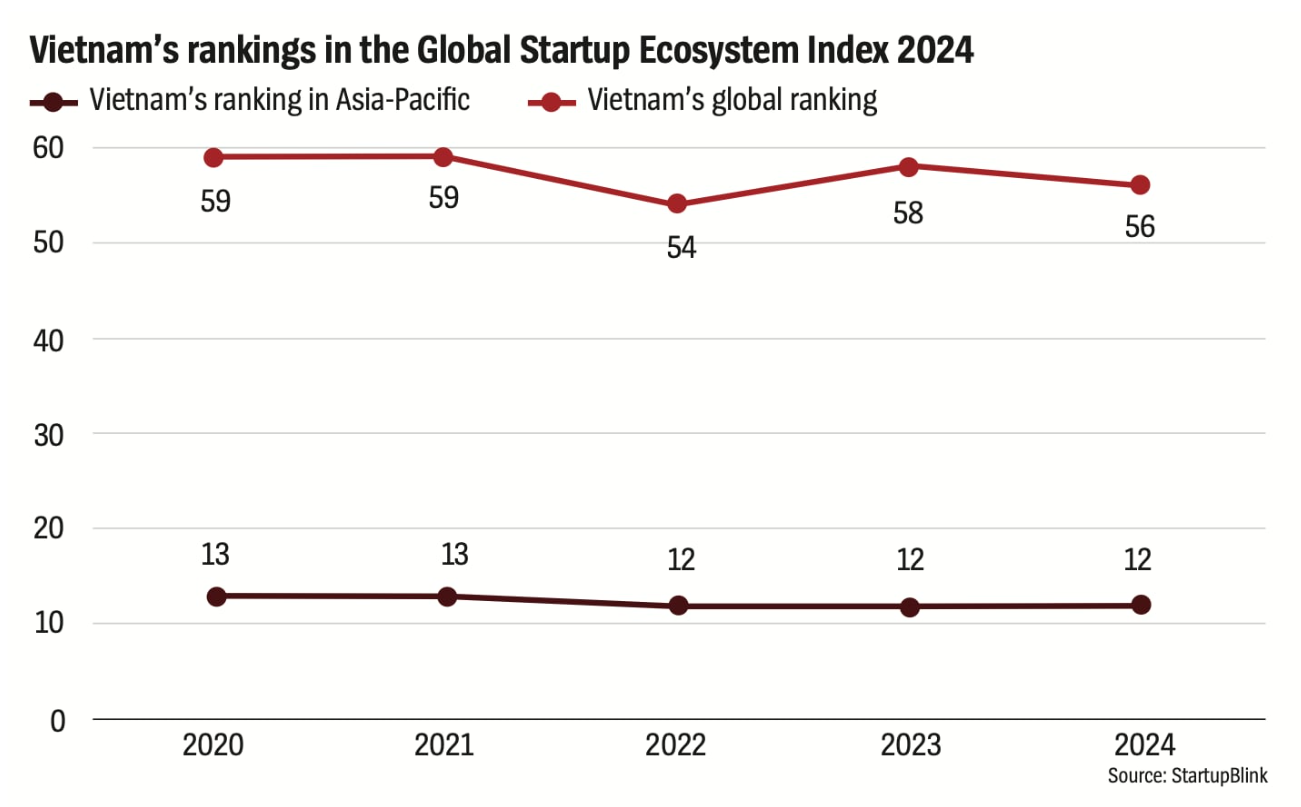

According to the Global Startup Ecosystem Index 2024 from StartupBlink, Vietnam rose two positions globally, moving from 58th in 2023 to 56th in 2024. This upwards move is widely regarded as a sign of its steady and promising progress in nurturing its innovation landscape.

It also reflects the country’s ongoing efforts to cultivate a dynamic, creative, and investor-friendly startup environment, and affirms that Vietnam’s strategy to enhance its appeal among global investors is gradually delivering tangible outcomes, helping position the country more firmly on the map of emerging innovation hubs.

Meanwhile, the National Innovation Center (NIC) has reported that, in 2024, there were 141 investment deals in Vietnam’s startup sector, with total disbursed capital estimated at some $2.3 billion. Most investments came from funds based in Singapore and Japan, together with a few domestic sources.

Building on the achievements of last year, Vietnam’s startup ecosystem kicked off 2025 with a number of positive developments. One notable deal was in February, when agri-tech startup Techcoop successfully raised $70 million in a Series A round led by TNB Aura from Singapore and Ascend Vietnam Ventures from Vietnam.

Shortly after, in early March, local AI startup Filum AI announced it had raised $1 million from leading regional investors including Nextrans, VinVentures, TheVentures, and strategic partners.

“As AI becomes an irreversible global trend, we hope this deal will unlock greater collaboration opportunities not only in funding but also in strategy and technology, helping Vietnam become a leading AI hub in the region,” Mr. Tran Van Vien, CEO Filum AI shared.

Though these deals may not be the largest in terms of capital raised, they are still widely viewed as positive and encouraging, especially in the context of the global economy witnessing many fluctuations due to the new US tariff policies.

To sustain this growth momentum, the NIC and the Vietnam Private Capital Association (VPCA) signed a series of MoUs at the Vietnam Innovation and Private Capital Investment Forum 2025 (VIPC Summit 2025) in Hanoi on April 22 with three leading Asian investment associations: the Korea Venture Capital Association (KVCA), the Singapore Venture & Private Capital Association, and the Hong Kong (China) Venture Capital and Private Equity Association.

With combined assets under management (AUM) of over $5 trillion, these partnerships are expected to foster a strong regional investment bloc and accelerate the growth of Vietnam’s startup ecosystem in both breadth and depth. It also reflects the international investment community’s growing confidence in Vietnamese startups.

With a series of recent positive developments, Vietnam’s startup ecosystem has been building a solid foundation for strong growth in the time ahead. This growth is expected to not only expand in scale but also evolve comprehensively across multiple sectors within the entire innovation value chain. From research and development to technological application and product commercialization, Vietnam is on track to form a more inclusive and sustainable ecosystem.

According to Ms. Ngo Thuy Ngoc Tu, Co-founder of Touchstone Partners, Vietnam is showing remarkable dynamism in the technology sector. This is reflected in the emergence of modern laboratories, a steadily growing base of intellectual property (IP), and a significant number of high-value research outcomes.

“These elements not only underscore Vietnam’s innovative potential but also indicate that the country possesses a strong foundation in infrastructure and resources to develop breakthrough technologies, contributing to the growth of a startup community truly driven by innovation,” she emphasized.

PROMOTING FAVORABLE APPROACHES

Despite these positive signs, experts caution that 2025 will continue to be a challenging year for startups, largely due to persistent global uncertainties driven by geopolitical tensions, ongoing trade disputes, and a volatile investment environment. These external factors are compounding existing structural weaknesses in many startup ecosystems, particularly in emerging markets like Vietnam.

According to Dr. Nguyen Duc Kien, former Head of the Prime Minister’s Economic Advisory Group, one of the most critical bottlenecks hindering the growth of local startups is the lack of funding channels for their later stages of development.

While early-stage capital such as Seed, Series A, and Series B rounds remains relatively accessible through angel investors and venture capital firms, capital for growth-stage rounds from Series C onwards is exceedingly difficult to secure domestically.

These later rounds often require significant investments, of $50 million or more, which are beyond the reach of most local funds. Consequently, many promising startups are left with few options: either exit the market early through acquisition, or face stagnation and eventual failure due to capital constraints.

To address this, Dr. Kien proposed that Vietnam adopt appropriate solutions to support startups in overcoming this critical growth stage, particularly by improving access to large-scale funding sources. In addition, it is essential to enhance the legal framework, tax policies, and investor protection mechanisms to create a more favorable, transparent, and attractive environment for investment in innovative startups.

Without timely and decisive measures, Vietnam risks missing the opportunity to nurture future tech unicorns. “Several countries in the region have embraced a differentiated approach by developing specific mechanisms for tech enterprises, successfully attracting large-scale capital,” Dr. Kien said. “Vietnam cannot afford to be left out.”

From another perspective, Ms. Tu stressed that one of Vietnam’s strategic priorities should be the acceleration of technology transfer and the commercialization of IP and experimental technologies.

Many promising startup ideas and scientific research outputs in Vietnam are still stuck in laboratories or small-scale prototypes due to a lack of mechanisms to effectively connect with businesses, investors, and production or application platforms.

“If Vietnam can address this challenge, it will not only enhance the value of its innovations but also elevate the country’s role as a key link in the global technology value chain,” she emphasized.

To overcome these challenges and promote the startup ecosystem, the Vietnamese Government has identified the development of tech enterprises and innovation-driven startups as a key pillar of the country’s digital transformation agenda.

Under government directives, in 2025, ministries and sectors are expected to complete legal frameworks that will enable more flexible capital mobilization for startups, while also developing long-term support programs for ecosystem growth.

Speaking at the VIPC Summit 2025, Deputy Prime Minister Nguyen Chi Dung reaffirmed the government’s commitment to improving the legal environment, enabling experimentation, application, and commercialization of technologies, and strengthening international cooperation in this field.

To ensure continued momentum in 2025 and beyond, he called on investment funds to accelerate decision-making and capital disbursement to seize the opportunities presented by the ongoing digital transformation.

The Deputy Prime Minister also emphasized the crucial role of ministries, research institutes, universities, and innovation centers in acting as bridges, creating a transparent, open, and efficient platform for businesses, organizations, and individuals to actively participate in the innovation journey in the years to come.

Google translate

Google translate