PVcomBank & Vemanti Group sign digital banking platform agreement

Two to work together on developing a digital banking platform for local SMEs.

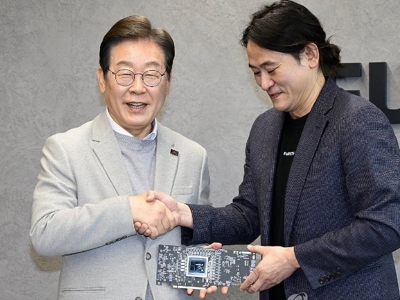

On March 21 at the bank’s headquarters at 22 Ngo Quyen Street, Hoan Kiem district, Hanoi, PVcomBank and the Vemanti Group from the US signed a cooperation agreement on the design, development, and provision of a digital banking platform for small and medium-sized enterprises (SMEs). The signing is a new step in the cooperation between the two parties and will contribute to accelerating the bank’s digitization process.

In the era of industrial revolution, technology is a key that opens up opportunities for growth in every field. To make good use of these opportunities, businesses, especially in the banking and finance industry, need to undergo a comprehensive digital transformation. At PVcomBank, digital transformation is a long-term strategy and vision, contributing to optimizing products and services and providing customers with convenient experiences when transacting with the bank. Digitization and the connection between the banking system and common ecosystems will contribute to increasing benefits for customers, banks, and the national economy.

To realize these goals, PVcomBank has been focusing resources on developing a team of technology experts and seeking reputable partners in the provision and development of a digital banking system. The Vemanti Group possesses strengths in the development of the neobank model - which PVcomBank is also aiming for. Operating in the field of multi-asset technology and investing mainly in emerging and high-growth markets with a core strength in investing and developing tech companies, the Vemanti Group has extensive experience and knowledge in providing non-traditional financial services, including lending and payment solutions to SMEs in Vietnam and Southeast Asia. This is also the customer segment PVcomBank is focusing on in the current period.

Under the agreement, based on PVcomBank’s inherent strengths in branch network, brand value, and products and services trusted by customers, the Vemanti Group will use cloud computing, APIs, artificial intelligence (AI), machine learning, and blockchain technology for the digital platform. At the same time, the two sides will work together to research and provide SMEs in Vietnam with innovative digital financial solutions through PVcomBank’s existing core banking system.

The digital banking platform the Vemanti Group provides will allow customers to sign up for an account and access services entirely online, while still having the option of going to a convenient branch location if needed. All customers will have access to tailored banking services and financial products that can be seamlessly integrated into their business. The hybrid model enabled by the Vemanti platform will allow customers to fully utilize digital services while also having the ability to take advantage of PVcomBank’s physical branch locations if needed.

Mr. Nguyen Viet Ha, Deputy General Director of PVcomBank, emphasized the importance of digital banking and expressed his appreciation of this cooperative arrangement with the Vemanti Group. “Digital transformation is a key goal at PVcomBank, and the Board of Management has set forth long-term strategic directions with serious investment,” he added. “We believe that Vemanti, with its professionalism, prestige, and many years of experience in cooperation with international financial institutions, will support PVcomBank to accelerate and secure progress in comprehensive digitalization, bringing modern financial solutions with many sustainable values for customers.”

“By leveraging Vemanti’s core competencies in providing digital solutions for SME clients, we are able to create a whole new banking experience for entrepreneurs and business owners,” said Mr. Tan Tran, Managing Director of the Vemanti Group. “We are looking forward to cooperating with PVcomBank, and with our strength and many years of experience, Vemanti can well serve the bank’s customers and Vietnam’s banking and finance industry.”

With the advantages each party holds, this cooperation will bring many benefits to both, elevating brand value in the market and increasing the experience and serving the needs of customers. On that basis, the two sides will continue to lay the foundation for further cooperative plans in expanding services, developing an ecosystem of partners and customers, and diversifying other financial solution packages in the future.