Western Union and MoMo announced a strategic cooperation agreement on March 20 that will enable MoMo app users to receive Western Union money transfers.

This is the first time a money transfer operator’s services have been made available on a super app in Vietnam.

Exclusive insights from Western Union research show that a staggering number of consumers in Vietnam (81 per cent) want money transfer providers to integrate capabilities into one “super app”. The announcement on March 20 means consumers will be able to do just that.

MoMo’s 31 million users can now receive Western Union money transfers digitally from over 200 countries and territories around the world.

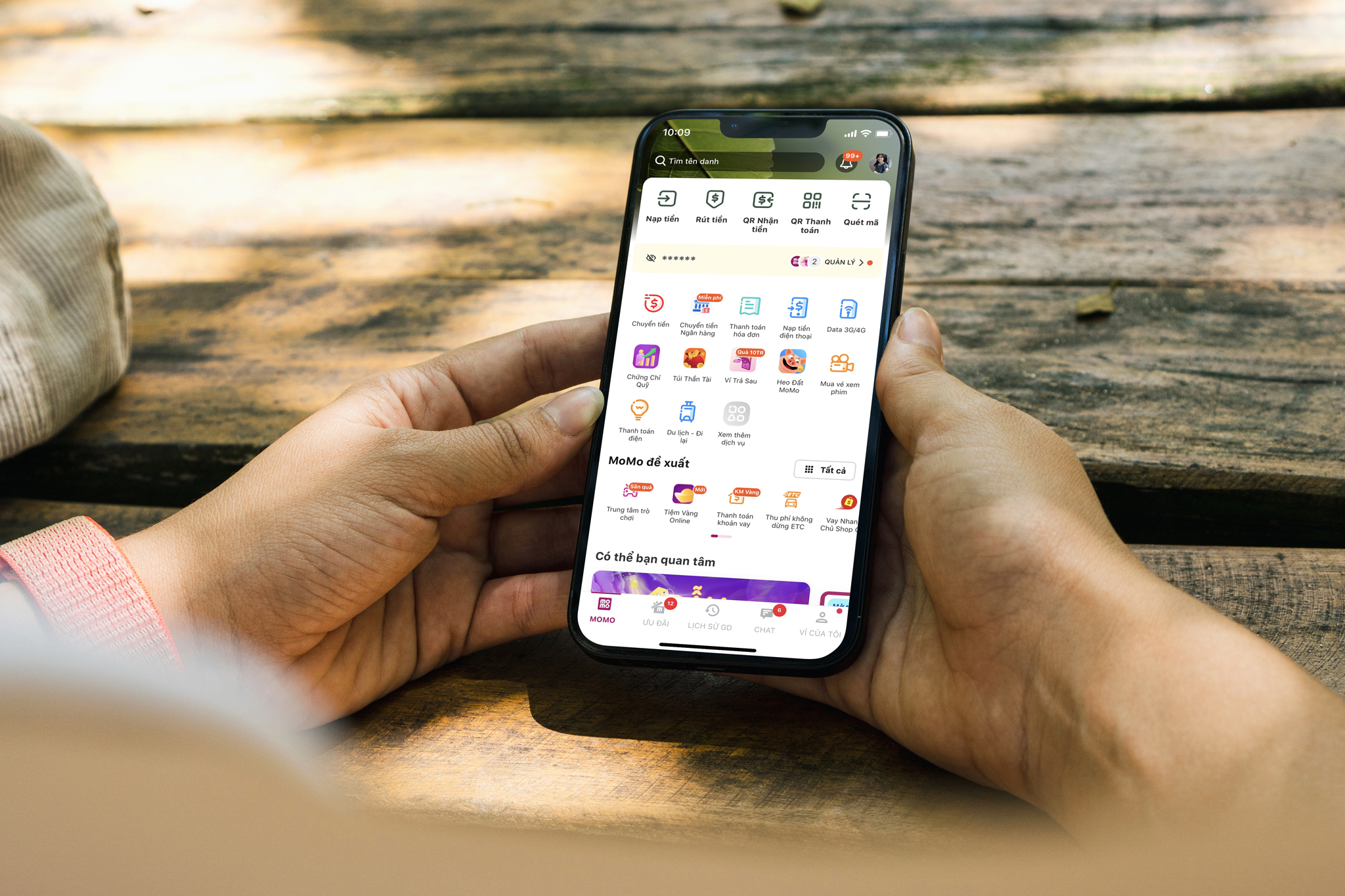

Collecting funds can be completed with just a few easy steps. Customers can search for “Western Union” on the MoMo app and input their Money Transfer Control Number (MTCN). Once completed, they will be able to route their transfers to the MoMo app and then into their bank accounts held with any of MoMo’s 50 partner banks.

The announcement advances both companies’ digital strategies by offering seamless customer experiences to consumers. Adding this service to MoMo’s ecosystem reinforces its position as the leading fintech company in Vietnam. It also bolsters Western Union’s recently announced Evolve 2025 strategy to offer high-value and accessible digital and retail financial services.

Mr. Atish Shrestha, Head of Indochina Region at Western Union, said Vietnam has been going from strength to strength, building the fastest-growing digital economy in Southeast Asia. “With this cooperation, we look forward to advancing our digital strategy and enabling a seamless customer experience for millions of MoMo users,” he added. “We are excited to cooperate with MoMo, inspiring each other with innovative thinking and concepts for building a cross-border financial ecosystem that addresses consumer needs, both today and tomorrow.”

“Through our research, we found that there was a rising need among overseas Vietnamese to send small amounts of money home to their families in Vietnam,” said Mr. Do Quang Thuan, Senior Vice President in charge of the Financial Services Business Unit at MoMo. “Thanks to the new service, Vietnamese will now be able to receive Western Union money transfers through MoMo for many purposes, such as family support and festive and celebratory occasions. Through low cost and speedy remittance services, MoMo hopes to bring people closer together, bridging the gap between overseas Vietnamese and their families in the country.”

According to the World Bank, Vietnam was the tenth-largest remittance-receiving country in the world in 2022 and third-largest in East Asia and Pacific, receiving approximately $19 billion. These figures underscore the importance of convenient digital channels for cross-border money transfers and the importance of partnerships to drive global connectivity.

![[Phóng sự ảnh] Sắc đỏ tự hào tại concert “Tổ quốc trong tim”](https://premedia.vneconomy.vn/files/uploads/2025/08/11/e9f82a09d6144b3098a3fd513396124a-3119.jpg?w=302&h=182&mode=crop)

![[Interactive]: Toàn cảnh kinh tế Việt Nam tháng 7/2025](https://media.vneconomy.vn/302x182/images/upload/2025/08/0675413e3e-4a53-4c15-ae1f-e8883264607e.png)