A highlight in attracting foreign investment

Northern Quang Ninh province will need to improve local human resources if it hopes to meet its target of attracting $3 billion in FDI this year.

Foreign-invested enterprises (FIEs) have made pivotal contributions to socio-economic development in northern Quang Ninh province over recent times, with provincial leaders long recognizing and valuing FDI as an important external resource in boosting local economic growth.

A host of solutions have already been introduced in a bid to ensure that Quang Ninh is a highlight in Vietnam in terms of attracting and effectively using foreign investment, and such efforts must continue.

FDI highlight

FDI capital flows into Vietnam are forecast to continue rising in 2024 despite the global economic difficulties.

It attracted $6.17 billion in newly-registered, additional, contributed capital, and capital to purchase shares from foreign investors in 48 countries and territories in the first quarter of the year, a year-on-year increase of 13.4 per cent, figures from the Foreign Investment Agency at the Ministry of Planning and Investment reveal.

This is an impressive result given that many economists have expressed concern that the application of a Global Minimum Tax (GMT) may impact Vietnam’s FDI attraction. It is clear, however, that foreign investors still view the country as a safe and viable investment destination.

According to Mr. Nguyen Duc Do, Deputy Head of the Financial Economy Institute at the Vietnam Academy of Finance, Vietnam possesses many advantages in attracting capital from leading foreign corporations, particularly those seeking long-term operations.

Its $3.11 billion worth of registered FDI capital last year ranked Quang Ninh third nationwide, after Ho Chi Minh City and the nearby port city of Hai Phong. In terms of annual growth in FDI capital, it led the way, with 42.3 per cent.

In the opening two months of 2024 it attracted eight new FDI projects with combined capital of $478 million, including two projects in manufacturing and processing and the high-tech sector. Gokin Solar from Hong Kong (China) is to build a photovoltaic cell technology complex at the Texhong Hai Ha Industrial Park in Hai Ha district, with the largest capital investment of the two, of nearly $275 million. The complex will have a capacity of 1.4 billion products a year. The IKO Thomspon Vietnam Co., Ltd, meanwhile, will invest $57 million in a factory producing bearings and linear motion equipment at the Song Khoai Industrial Park, with an annual capacity of 930 tons of products.

Quang Ninh is expected to attract $1 billion worth of FDI during the first quarter, equivalent to one-third of its annual plan, according to the province’s Management Board of Economic Zones, after being scheduled to welcome an additional seven projects from the US, China, and Taiwan (China) in March.

As of the end of 2023, it was home to nearly 200 FIEs from 20 countries and territories with combined investment of nearly $14 billion.

The province has set a target of posting gross regional domestic product (GRDP) growth of more than 10 per cent this year, with GRDP per capita to stand at over $10,000, creating a firm foundation for achieving its socio-economic development plan for the 2025-2030 period.

It has prioritized FDI attraction in the fields of manufacturing and processing and high technology with a focus also on environmental-friendliness, high investment efficiency, and substantial added value, to contribute to boosting the province’s growth and participation in the global value chain.

Quang Ninh’s target this year is to attract more than $3 billion in FDI and to have at least 2,000 new enterprises enter into operations.

People improvements needed

Local authorities have identified that better FDI flows will help the province grow quickly and increase development investment sources, boost production capacity, accelerate economic restructuring, and generate more employment. Quang Ninh has therefore paid significant attention to creating the necessary conditions to attract investors and continued to improve local economic zones and industrial parks.

Apart from incentives relating to taxes, land, and administrative procedures, together with cheap labor costs, as found in other localities, it boasts superior advantages for foreign investors in having ready access to both domestic and foreign markets due to its geographical location and also boasts favorable conditions in high technology and semiconductors, green energy, the digital economy, and the green economy.

Some analysts believe that a GMT will not overly affect FDI coming into Vietnam, as giant investors will be swayed by the country’s advantages. New policies also suggest that the majority of new investors are not subject to a GMT or will only be negligibly affected by the tax scheme.

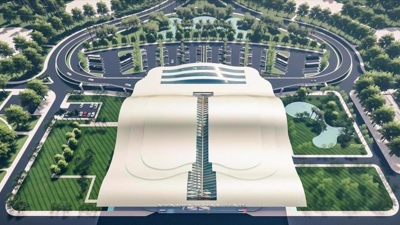

Quang Ninh has adopted many measures to attract quality FDI capital flows, including accelerating planning, building appropriate infrastructure, and improving its human resources to meet the requirements of investors, according to Chairman of the Quang Ninh Provincial People’s Committee Cao Tuong Huy.

The Committee has asked investors in economic zones and industrial parks to complete infrastructure and tackle difficulties facing subsequent investors who lease land within their boundaries.

Quang Ninh has also been steadily investing in completing infrastructure networks such as expressways, airports, seaports, and power supply. Authorities at all levels have also paid greater attention to simplifying administrative procedures.

In order to fulfill its economic development and FDI attraction targets in 2024, it has determined to resolutely tackle shortcomings in activities relating to investment, such as consultancy, survey, design, preparation, and bidding, and to accelerate capital disbursement for projects scheduled for completion this year, according to Mr. Nguyen Xuan Ky, Secretary of the Quang Ninh Provincial Party Committee.

However, in order to absorb high-quality FDI and improve investment efficiency, Quang Ninh must do more to ensure its human resources can master core technology, chip technology, and other new technologies.