ADB: Vietnam’s local currency bond market grew by 7.7 per cent in Q1/2024

The ADB report, released on June 26, singled out Vietnam and Thailand as two economies that have witnessed growth in their LCY bond markets after contractions in the preceding quarter.

According to the “Asia Bond Monitor” report, which was released by the Asian Development Bank (ADB) on June 26, bond yields in the emerging East Asia region increased amid strengthened expectations that interest rates will remain elevated for a longer period. While slower-than-expected disinflation supported the likelihood of higher-for-longer interest rates and pushed up short-term and long-term bond yields in both advanced economies and regional markets.

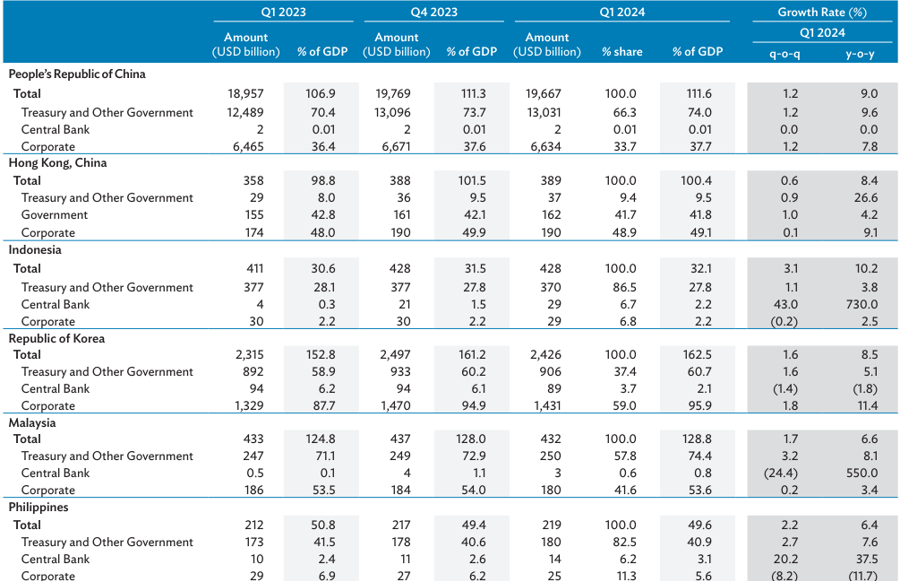

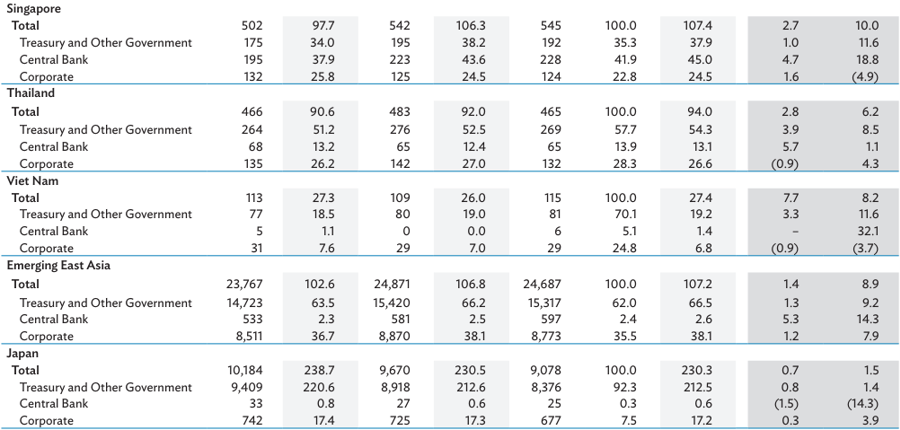

The emerging East Asia markets includes ASEAN member economies, China, Hong Kong (China) and the Republic of Korea (ROK). According to the report, the emerging East Asian local currency (LCY) bonds outstanding rose to $24.7 trillion at the end of March on a year-on-year expansion of 8.9 per cent. The pace of annual growth in emerging East Asian LCY bonds outstanding continued to surpass that of the US (7.8 per cent) and the European Union 20 (EU-20) (6.1 per cent).

The ADB’s report singled out Vietnam and Thailand as two economies that have witnessed growth in their LCY bond markets after contractions in the preceding quarter. Accordingly, Vietnam’s bond market grew by 7.7 per cent quarter on quarter in the first 3 months of this year, compared to a drop of 0.4 per cent in the last quarter of 2023.

The bank stated that this latest improvement of the Vietnamese bond market is driven by increased issuance from the government and the State Bank of Vietnam’s resumption of central bank bills issuance in March to support the Vietnamese dong (VND).

Treasury and other government bonds reached VND2,004.2 trillion ($78.69 billion), which accounted for the majority of Vietnam’s total debt stock, grew 3.3 per cent quarter on quarter in Q1 of this year, due to increased issuance to support the government’s funding requirements.

On the other hand, corporate bonds, worth VND709.7 trillion ($27.8 billion), which comprised 24.8 per cent of the total LCY bond market at the end of March, contracted by 0.9 per cent quarter on quarter due to a large number of maturities and a low volume of issuance during the quarter.

Despite the LCY bond market growing by 7.7 per cent, corporate bond issuance contracted 81.3 per cent compared to the last quarter, a reversal from the previous quarter’s expansion of 74.5 per cent.

According to the report, under the Government's Decree No.08/2023/ND-CP, several provisions from Decree No.65/2022/ND-CP had been suspended or postponed. The reinstitution of these provisions have not yet been made until the beginning of 2024, however. This interruption therefore created challenges for corporate bond issuers due to difficulties in meeting the requirements of Decree No. 65.

Meanwhile, central bank bill issuance contracted 45.2 per cent quarter on quarter since the State Bank of Vietnam only resumed issuance during the last month of the quarter. At the same time, the issuance of Treasury and other government bonds increased more than twofold from the previous quarter to VND90.5 trillion ($3.55 billion).

Due to an absence in new issuance, the Vietnamese sustainable bond market - composed of green bonds and sustainable bond instruments issued solely by corporates - shrunk by 0.5 per cent quarter on quarter to $800 million in Q1 of this year.

More than half (53.4 per cent) of the sustainable bond stock consisted of sustainability bonds carrying maturities of 3 years or less, and the remaining 46.6 per cent were green bonds, about 54 per cent of which carried tenors of 3 years or less, resulting in an average tenor of 3.2 years.

Foreign-currency denominated instruments comprised over 70 per cent of the economy’s total sustainable bonds at the end of March.

The ADB’s report showed that at the end of March, the market size of emerging East Asian LCY bonds was equivalent to 64 per cent of the US bond market (USD38.6 trillion) and 115.3 per cent of the EU-20 (USD21.4 trillion). This is mostly driven by the bond markets in China, South Korea and Japan.

“Emerging East Asia’s financial conditions remain resilient,” said ADB Chief Economist Albert Park. “But lingering geopolitical tension and adverse climate events pose upside risks to inflation, adding uncertainty over the path of disinflation. Some regional monetary authorities may hold interest rates higher for a longer period to safeguard currencies amid the uncertainty in disinflation trends and global monetary stances”, he added.