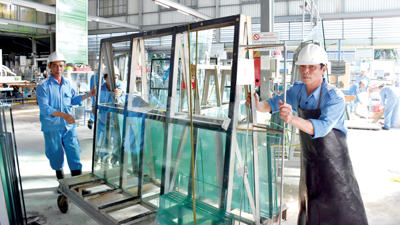

An upward spiral in industrial production

The General Statistics Office (GSO) has reported that the Index of Industrial Production (IIP) increased by 0.7 per cent in July compared to June and by 11.2 per cent compared to July 2023, and is estimated to have risen 8.5 per cent year-on-year in the first seven months.

The manufacturing and processing sector, which increased 9.5 per cent, contributed 8.2 percentage points to the overall growth of industry, while the production and distribution of electricity sector grew 12.4 per cent, contributing 1.1 percentage points, and the water supply, waste management, and treatment sector rose 7.2 per cent, contributing 0.1 percentage points. Conversely, the mining sector fell 6.2 per cent, shaving 0.9 percentage points off the IIP.

Growth across sectors

The GSO report shows growth in industrial production around Vietnam during the first seven months, with 60 of the country’s 63 cities and provinces experiencing an increase in their IIP compared to the same period of 2023. Notable year-on-year increases were seen in the manufacturing and processing sector in the provinces of northern Lai Chau, by 43.1 per cent, northern Phu Tho, by 38.4 per cent, northern Bac Giang, by 27.5 per cent, southern Binh Phuoc, by 17.1 per cent, north-central Thanh Hoa, by 15.1 per cent, and northern Dien Bien, by 8.8 per cent. In the production and distribution of electricity sector, significant increases were posted in south-central Khanh Hoa province, of 258.5 per cent, Lai Chau province, of 66.4 per cent, northern Cao Bang province, of 62.1 per cent, Dien Bien province, of 51.8 per cent, northern Son La province, of 35.2 per cent, Thanh Hoa province, of 33 per cent, and Phu Tho province, of 15.3 per cent.

Some provinces, meanwhile, recorded low year-on-year growth or a decline in the IIP in the manufacturing and processing sector in the period, including the Mekong Delta’s Ca Mau, of +1.5 per cent, the central highlands’ Gia Lai, of +0.3 per cent, north-central Ha Tinh, of -8 per cent, and central Quang Ngai, of -4.2 per cent. Regarding the production and distribution of electricity sector, low increases or declines were posted in the provinces of central Quang Tri, of +1.7 per cent, Quang Ngai -16.9 per cent, central Thua Thien-Hue -16.1 per cent, northern Lang Son -15.5 per cent, the central highlands’ Lam Dong -5.6 per cent, and Gia Lai -3.6 per cent. In the mining industry, provinces seeing a decline in the IIP included southern Ba Ria-Vung Tau, of -14.3 per cent, Lam Dong, of -8.6 per cent, Quang Tri, of -4.7 per cent, Lang Son, of -3 per cent, and Thua Thien-Hue, of -1.6 per cent.

Regarding the workforce at industrial enterprises, the GSO report noted that as of July 1, the number of employees had increased by 0.9 per cent compared to June 1 and by 3.3 per cent compared to July 1, 2023. Specifically, employment at State-owned enterprises increased by 0.1 per cent month-on-month and by 1.5 per cent year-on-year, in non-State enterprises by 0.5 per cent and 0.7 per cent, respectively, and in foreign-invested enterprises by 1.2 per cent and 4.3 per cent, respectively.

By sector, the number of employees working in mining enterprises increased 0.1 per cent month-on-month and by 0.4 per cent year-on-year, in the manufacturing and processing sector by 1.0 per cent and 3.5 per cent, respectively, in the production and distribution of electricity, gas, hot water, steam, and air conditioning sector remained unchanged month-on-month and increased 1.1 per cent year-on-year, and in the water supply, waste management, and treatment sector decreased 0.1 per cent month-on-month and increased 1.2 per cent year-on-year.

FDI in manufacturing and processing a highlight

The manufacturing and processing sector reaffirmed its “Number 1” position in FDI attraction in industry. As of July 20, it had secured the highest volume of newly-registered FDI capital, of $7.88 billion, accounting for 73.2 per cent of total new capital.

When including both newly-registered and additional capital to existing projects, FDI in the manufacturing and processing sector totaled $12.23 billion, representing 77.8 per cent of total new and additional capital and underscoring the sector’s strong appeal among foreign investors.

A significant factor positively impacting industrial production over the first seven months of the year was Vietnam’s Manufacturing Purchasing Managers’ Index (PMI). According to a report from S&P Global released on August 1, the PMI in July stood at 54.7 points, indicating substantial improvement in business conditions across all categories of consumer goods, intermediate goods, and capital goods.

The report also noted that the number of new orders increased in July for the fourth consecutive month, driven by stronger market demand and a growing customer base. In response to the surge in new orders, manufacturers significantly increased production during the month, with growth surpassing the figure posted in June.

“Expectations for continued growth in new orders over the next year have bolstered business confidence in production prospects,” the S&P Global report stated. “Vietnam’s manufacturing sector has carried the robust growth momentum from June into July, fostering optimism that we are entering a period of strong growth, contributing to the advancement of the economy.”

According to the Ministry of Industry and Trade (MoIT), the industrial production results for the first seven months of 2024 can be attributed to effective government support measures and the decisive directives from the Prime Minister regarding public investment disbursement and the implementation of key industrial projects. The attraction and disbursement of FDI also bolstered domestic production capacity.

Furthermore, the global market’s recovery has gradually stabilized, adapting to the significant fluctuations experienced in 2022 and 2023. The increase in new export orders has driven domestic production sectors. Moreover, the capabilities of enterprises, especially domestic enterprises, have improved thanks to the combined effects of government support policies and the strengthened confidence resulting from a stable domestic macro-economic environment and trends in global market recovery.

Need for comprehensive solutions

Despite achieving positive growth in the first seven months of 2024, Vietnam’s industry still faces numerous short and long-term challenges, according to the MoIT. While improvements have been made, domestic production remains weak, and significant industry bottlenecks have yet to be effectively resolved. Production is still heavily reliant on external factors, particularly the FDI sector.

Moreover, the value added by domestic industries continues to be low, with underdeveloped supporting industries and few high-tech industrial products. Industrial production recovery is not comprehensive as yet, with some key sectors like smartphones, televisions, automobiles, and raw steel declining compared to the first seven months of 2023. Certain major export products have recovered, such as footwear, wooden products, and various types of phones and components, but have not yet returned to their peaks in the same period of 2022.

Looking ahead to the final five months of 2024 and beyond, the global and regional situations are expected to remain complex and unpredictable. Geopolitical tensions and major power competition are forecast to intensify, the recovery of major trade partners will remain slow, and there are potential risks of disruptions in global supply and production chains. Major export items to key markets such as Europe and the US continue to face pressures from trade defense investigations and technical barriers.

To ensure stable and sustainable growth in industry, the MoIT emphasizes the need for comprehensive, long-term, and robust solutions. It will continue to implement government-approved support policies to help businesses overcome difficulties in production and business activities, particularly in key export sectors such as textiles and footwear, and foundational industries like automobiles, machinery, and steel. Efforts will also focus on expediting the operation of new industrial production projects to enhance production capacity and export goods.

Additionally, the MoIT will focus on advising and completing institutions, policies, laws, and development strategies for foundational industrial sectors, prioritizing new growth resources in both the short and long term. It will continue its effective programs with localities to restore and promote industrial growth in cities and provinces and in key economic regions.

The Ministry will also support enterprises in taking advantage of opportunities from large public investment projects and government policies to revive the real estate market, encourage an increase in domestic product procurement, to limit the use of imported products and materials that can be produced domestically, and continue to seek new markets for key export sectors, thereby promoting the development of domestic production sectors.