Behind closed doors

Retail space proved difficult to fill in 2021 but the market appears to be heading towards better days.

Outbreaks of Covid-19 made for a difficult 2021 in Vietnam’s retail market, with the woes experienced by retailers translating into empty shops. Many leases were ended, to the detriment of the retail real estate segment overall. A lot of work is now going into filling the myriad vacancies, according to Savills Vietnam.

Tough times

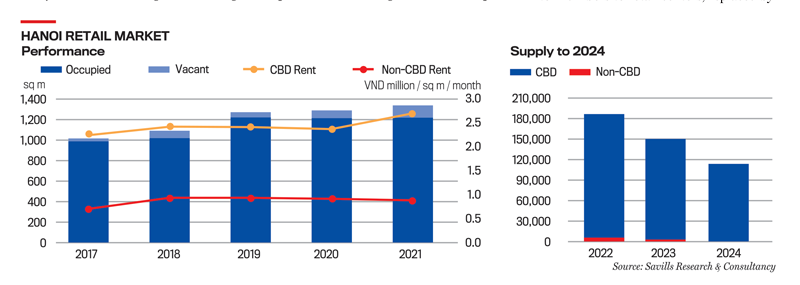

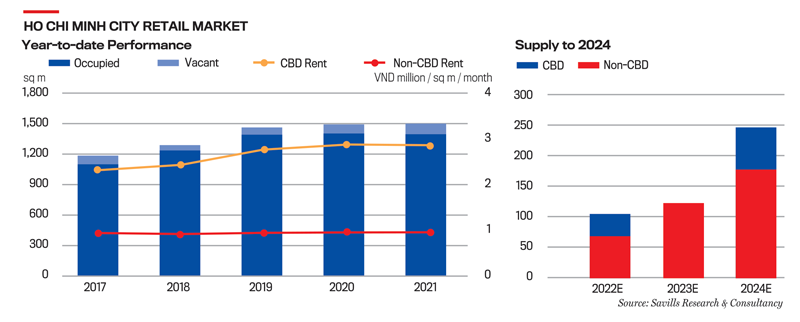

A recent Savills report reveals a decline in the retail sales of goods and services in Vietnam. Revenue for 2021 came in at VND4.79 trillion ($212 million), down 3.8 per cent against 2020. Ms. Hoang Nguyet Minh, Director of Commercial Leasing at Savills Hanoi, said the market witnessed many businesses closing or relocating. In the fourth quarter, leasing capacity in Hanoi fell 2 percentage points (ppts) quarter-on-quarter and year-on-year, to 92 per cent. In Ho Chi Minh City, average retail occupancy was down 1 ppt quarter-on-quarter and year-on-year, to 93 per cent.

Notably, the retail podium category posted the steepest declines. Occupancy at those in Hanoi fell the most, due to newly-launched projects struggling from the outset. The east of the capital suffered the most in the fourth quarter, with take-up of net-leasable area (NLA) down 7,000 sq m. Meanwhile, retail podiums and shopping centers in Ho Chi Minh City saw a 1 ppt quarter-on-quarter fall in occupancy, driven by tenants terminating leases early or non-performers vacating once leases expired. Forty per cent of vacating tenants were in the food and beverage (F&B) industry. The sub-shopping center segment and retail kiosks saw significant declines in occupancy, of up to 3 ppts quarter-on-quarter and year-on-year. Though kiosk landlords cut rents by 20 to 50 per cent and removed minimum rental periods, vacancies were still difficult to fill.

Mr. Christian Olofsson, Property President at Central Retail Vietnam, told VET that the hardest hit tenant categories from social distancing restrictions were F&B and entertainment.

Similarly, Mr. Furusawa Yasuyuki, General Director of Aeon Vietnam, told VET that restaurants, entertainment venues, and retail outlets in shopping malls, especially in the south, closed after bans on the sale of non-essential items were imposed as Covid-19 raged. “The restrictions began last July, with business hours being shortened, and many businesses suspended operations,” he said. “We believe the pandemic significantly changed customer lifestyles, shopping habits, and product needs. In that sense, we think the most difficult management issue will be how to quickly grasp changes in customer thinking and adjust product lineups and prices, and changes to the composition of specialty stores in our shopping malls.”

Outbreaks and resulting social distancing measures made 2021 a bleak year for Vietnam’s retail market. Restrictions on direct contact saw disruptions to the business activities of service providers like restaurants, gyms, and spas. Generating income and paying rent became major concerns. Ms. Minh noted that in Hanoi’s retail space, brands became hesitant to open new locations and feared lockdowns and disruptions damaging existing outlets. In Ho Chi Minh City, meanwhile, Mr. Troy Griffiths, Deputy Managing Director of Savills Vietnam, said that traditional retail remains in the doldrums, with a clear transition to offline channels that is growing.

The prolonged pandemic decimated visitor numbers to retail centers, replaced by increased interest in online shopping. According to Vietnam Credit, 2021 saw growth of 18 per cent year-on-year in e-commerce; the highest in Southeast Asia. While out-of-store retail value grew 24 per cent year-on-year between 2017 and 2021, in-store retail value grew a modest 2 per cent, according to Euromonitor International. The potential online holds led many businesses to focus more on investing in online channels and gradually reducing the size of their physical outlets.

Efforts to recover

Amid difficulties for all, investors need to carefully calculate space structure, tenant allocation, and efforts to attract visitors, to ensure occupancy rates can grow and effective business operations can be maintained, according to Ms. Minh.

She also offered solutions for real estate developers to promptly meet tenant needs and resolve issues regarding premises. Firstly, retail lessors should consider adjusting rent plans and payment terms. For example, in order to ease financial pressure on brands as they recover, rents could be cut by 20-30 per cent and made up later in the lease. Secondly, marketing and communications activities need to be fully thought through by developers, to attract brands. Thirdly, unpredictable health developments mean backup plans need in be in place, ready for adoption. Another option lessors could consider is restructuring the premises, with podium floors in shopping centers and apartment blocks changing to office space.

Central Retail worked closely with existing tenants during the worst of the pandemic to offer support and ensure they were in a position to bounce back once operations could resume. Opening a store even in good times requires a substantial capital investment and carries a degree of risk, so business owners need reassurance they can earn a return on their investment. Central Retail is always looking for solutions to co-create concepts and help business owners lease space at low cost in its malls. Another example of how it has taken the initiative to work together with retailers is the creation of zones for fashion or mobile / IT / gadgets in its malls, where tenants can move right in and open their doors without major investments in store fit-outs and equipment. This is one way to ensure that local business owners lease space at malls for less cost and reap immediate benefits from having a large footfall, together with synergies from other tenants attracting similarly-targeted customers.

“With the exception of the negative impact on F&B and entertainment, Covid-19 in many ways presented few new challenges, but rather expedited what we already knew and sped up our plans to make our malls more relevant to customers and to update the tenant mix,” Mr. Olofsson said. “It is always difficult to see tenants leave, but at the same time it creates room for improvements and vitality that customers constantly seek.”

Aeon’s shopping malls are experiencing few major issues regarding empty space thanks to the efforts of each tenant. “In the future, however, to provide more attractive products and services to meet changing customer needs, we will cooperate with suppliers of competitive products and tenants that offer attractive products and services,” said Mr. Yasuyuki. “We also believe it is necessary to cooperate further with existing companies. To that end, Aeon shopping malls must continue to be attractive.”

Future prospects

Despite a tough period, Vietnam’s retail market has seen signs of recovery. Mr. Olofsson said Central Retail forecasts high occupancy in the time to come. “We see a clear upswing in tenant interest in expanding their business with us and positive sales at our malls,” he added. “We are very optimistic about Vietnam, with its strong economic growth, young, well-educated population, increasing private wealth, and strong desire among consumers to experience higher standards in products and services.”

Mr. Yasuyuki added that the biggest opportunity comes from the Vietnamese market still growing. “Along with that, customer lifestyles and shopping and payment methods will change,” he said “Covid-19 has accelerated customer change. From traditional markets to modern markets, from in-store purchases to online purchases, from cash to cashless payments, we believe that all these changes are opportunities for Aeon Vietnam to grow.”

Mr. Nagatsuma Hiroyuki, Communications Representative at AeonMall Vietnam, agreed that the country has a young population and expects further economic development through demographic dividends and urbanization. “Its retail market has developed vibrantly, with multi-channel forms,” he said. “In particular, growth in e-commerce has added excitement to the retail market over the past few years. However, consumers still need shopping malls to satisfy their most important requirement when shopping, which is to experience actual products.”

Though the benefits of the online business model are being accessed, Covid-19 hasn’t completely diminished the need for in-person services, according to Savills, especially in cosmetics, fashion, dining, and gymnasiums.

The impact of the pandemic has also caused many to reconsider their priorities and change their consumption preferences. Last year saw an explosion of young middle-class people interested in healthcare, sparking major growth at fitness centers, spas, clinics, and pharmacies. Grasping this potential, the developers of shopping malls and apartment projects need to identify appropriate and timely plans to meet customer desires, fulfill demand for premises among retail business households, and promote leasing activities.

While non-CBD buildings struggle to fill vacancies, the high-end CBD property market remains active. It is expected that within the next three years, central areas will see floor space grow.

According to Savills, the retail market will improve as the year unfolds thanks to two main factors: the expansion of large tenants and international brands, and a recovery in shoppers’ daily spend. According to data from McKinsey & Company, Vietnam will be catering to a new high-end consumer group by 2030 with spending of more than $70 a day.