BIDV & Dragon Capital Vietnam sign strategic cooperation in asset management

Two to provide asset management services for high-net-worth individual clients.

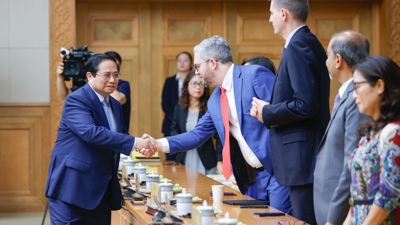

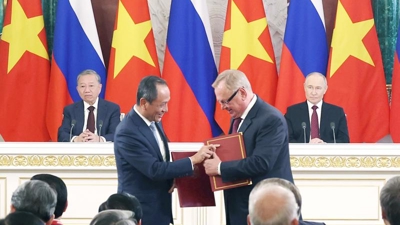

The Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) and Dragon Capital Vietfund Management (Dragon Capital) held a signing ceremony on April 18 for a strategic cooperation agreement to implement portfolio management solutions for private banking customers.

Dragon Capital will provide BIDV’s private banking customers with specialized investment solutions designed to match each customer’s risk appetite. The cooperation between the two leading names in the banking and asset management industries promises to bring specialized solutions based on international standards to establish new standards for asset management in Vietnam.

“Dragon Capital has contributed significantly to the development of the domestic fund management industry and will continue to shape and develop the asset management sector in Vietnam,” said Mr. Le Ngoc Lam, CEO of BIDV.

“The strategic cooperation affirms BIDV’s commitment to becoming a long-term partner, accompanying the development of customers,” said Mr. Beat Schurch, General Director of Dragon Capital Vietnam. “The cooperation with BIDV will bring many practical and sustainable benefits to individual customers and thereby create success in business activities for both sides.”

Dragon Capital is also a partner in supporting the construction and deployment of services and enhancing the capacity of BIDV’s expert team to serve high-net-worth individuals in Vietnam directly by a joint investment consultant team. They will provide personalized financial management solutions that meet the needs and desires of customers to sustainably and effectively preserve and develop their assets.

In 2022, the two organizations began their cooperative arrangement by launching Dragon Capital’s open-ended fund certificate product to BIDV’s priority customers. This formed a foundation for the two to deepen their strategic cooperation in the field of asset management and investment advisory for the priority customer segment.