Health awareness helping pharma chains

As Vietnam’s retail pharmaceutical market grows, so does the presence of pharmacy chains.

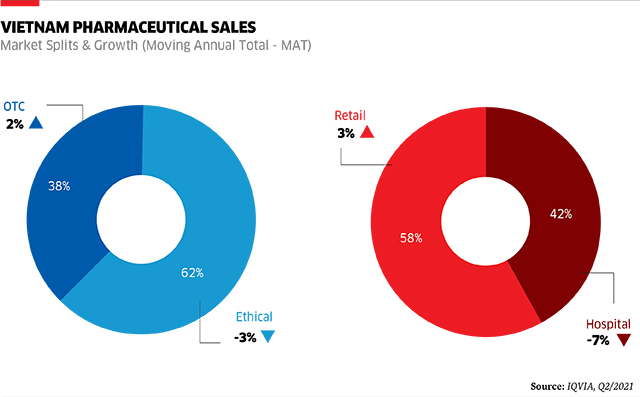

Healthcare has become top-of-mind for most people since the Covid-19 pandemic began, with consumer purchasing behavior reflecting an increased focus on health and wellness. The WellTrack report from health researchers IQVIA found that consumers increased their total basket size of pharmacy purchases during the pandemic and this resulted in a noticeable shift from the hospital channel to the retail sector. Patients have become more comfortable buying their medicine from neighborhood pharmacies and clinics and found this to be more convenient than going to a hospital. This has triggered increasing interest in Vietnam’s pharmaceutical retail market from large global and domestic players, especially modern retail chains.

Growth possibilities

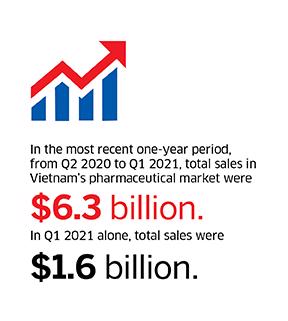

Vietnam’s pharmaceutical industry is indeed growing rapidly and is currently worth $7.4 billion, with $9.1 billion expected by 2023 and $16.1 billion by 2026, according to IBM Research. In addition, over the next five years, Vietnam is expected to maintain its position in the top 20 largest pharmaceutical markets in the world. “Vietnam’s healthcare system has developed significantly over the last 20 years and continues to strengthen and have a positive impact on the health and well-being of Vietnam’s population,” said Mr. Chris Blank, Founder and CEO of Pharmacity.

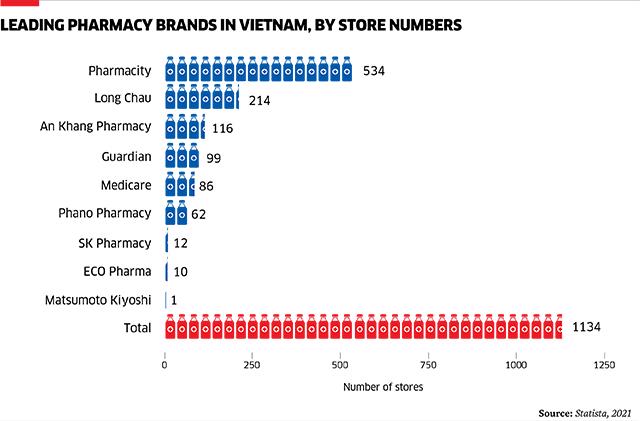

The largest pharmacy chain in the country, Pharmacity has over 600 stores and has set ambitious plans to expand to 5,000 by 2025 and post turnover of more than $1.5 billion, by giving half of the population ready access to a store within a ten-minute drive.

Another leading local chain, Long Chau Pharmacy, recorded positive performance last year. Revenue stood at $51.6 million, a dramatic increase of 133 per cent compared to 2019, while store numbers totaled 200, including 130 new outlets, covering 43 of Vietnam’s 63 cities and provinces. In the first quarter of this year, revenue came in at $25.2 million, a sharp rise of 144 per cent year-on-year, and it had 222 stores.

The government has taken a number of significant steps over recent years to improve the distribution and quality assurance of pharmaceutical products in order to address major issues such as counterfeits and the overuse of antibiotics. In this context, according to Mr. Blank, the implementation of the pharmacy retail chain model has helped support such efforts.

At the same time, he went on, free trade agreements have provided fair and equal access to the market, establishing favorable conditions for EU investors to expand in Vietnam and capture the rapid growth seen in the pharmaceutical industry. Local pharma companies have needed to rapidly adjust to this new market circumstance to ensure they can compete against larger international players.

Moreover, there has been a growing general interest in Western medicine as opposed to traditional medicine over the last few years, according to Mr. Petar Reshovski, General Manager of Williams & Marshall Strategy (WMS), a global market research and consulting firm. This has impacted consumer habits, as more and more local people are beginning to seek Western medicine over traditional medicine, especially for minor ailments. In order to adapt to these changing consumer habits, retailers must continue offering smaller medicine packs, bundle their offerings, open outlets in more convenient locations, and provide a better shopping experience, to name just a few measures. The expansion plans of some new market players have been delayed by Covid-19, but their investments in the country are expected to grow in the medium term.

Adaptive strategies

Covid-19 has changed the healthcare habits of many Vietnamese, with greater attention being paid to healthier eating, regular exercise, and dietary supplements. General wellness products such as vitamins, minerals, and supplements (VMS) have enjoyed a sales spike since the onset of the pandemic. “We have also seen a shift in purchasing behavior to lower-cost products such as Vietnamese brands and generics, and believe this could be due to job cuts or income reductions in the past year,” said Mr. Lucas Frontier, Country Director of IQVIA Vietnam. “Retailers are adjusting to this trend, providing lower-cost alternatives to popular medicines and VMS products.”

Vietnamese consumers are gradually increasing their demand and hence expenditure on healthcare products and services, Ms. Nguyen Bach Diep, Chairwoman of FPT Retail, the owner of Long Chau Pharmacy, has observed. Awareness has grown since Covid-19 made its presence felt, and people now view pharmacies in a different light. They simply seek a quality outlet where they can buy necessary medicines and also other healthcare products, with a preference for stores that are easily accessible.

“As one of the largest pharmacy chains in Vietnam, Long Chau offers a range of outstanding services such as in-store consultations from experienced and well-trained pharmacists, a wide product assortment, and other services to attract customers,” she said. “We have introduced convenient new experiences and advanced levels of customer service to secure customer loyalty. Long Chau also attaches special importance to upgrading the online shopping experience and delivery services.”

FPT Retail is focusing on opening more stores, with an expectation of doubling Long Chau’s revenue to around $104 million by expanding coverage to 350 outlets. “We will expand our exclusive product portfolio and upgrade our logistics network to ensure supply chain capabilities around the country,” Ms. Diep said. “FPT Retail considers the pharmaceutical segment to be a market of potential, and aims to secure a 30 per cent market share in retail pharmacy over the next two years, contributing 25 per cent of total revenue.”

Similarly, Pharmacity has also positioned itself as a tech-driven business. Through its omni-channel strategy, it provides customers with a seamless shopping experience between online and offline platforms. “Covid-19 has emphasized how important the role of the pharmacist is in society,” Mr. Blank said. “In Vietnam, local pharmacies are usually the first stop when you feel unwell. We have been serving the local community since the beginning of the crisis, despite the challenges. We have been able to provide all services and maintained stock levels for all our products, including our own brand face masks and hand sanitizer. In addition, we have accelerated our digital transformation and will be launching a super app and a new e-commerce website in the coming months that will further enhance our services.”

Fragmented market

Vietnam has an estimated 60,000 pharmacies nationwide, with traditional independent outlets representing the vast majority, according to IQVIA. “Currently covering just 3 per cent of pharmacies nationwide, modern pharmacy chains are rapidly gaining traction with consumers, due to accessibility, product and service diversity, and quality consistency,” said Mr. Frontier. “Led by Vietnam’s largest pharmacy chain Pharmacity, chains are expanding at a rate that will double the number of chain outlets within the next two years.”

IQVIA’s WellTrack report shows that consumer demand for quality medicines and services remains strong amid the Covid-19 pandemic. Other recent reports note that chains such as Pharmacity and Long Chau Pharmacy have announced further expansion plans, while international chains such as Matsumoto Kiyoshi and Watsons have recently arrived in Vietnam. All continue to adopt technological solutions to improve operations, provide more services to customers, and offer the most suitable products to meet customer needs. Chain pharmacies are likely to continue to expand for the foreseeable future.

The local market is highly fragmented and decentralized, according to Mr. Reshovski. “In many developing markets, however, this is expected to change in the long term,” he said. “The emergence of a few large players is forecast for the short term. Once these companies see their performance in the country and the possibilities for development, they are likely to start acquiring some of their competitors and thus gain a larger market share through acquisitions. Time will tell if and how this will work, but it is a phenomenon observed in many similar markets already.”

Small independent outlets have been hit hard by Covid-19, he went on. Many have been forced to close and thus lose their only stream of income. This has put business owners in a bad financial position and seen many cut their prices to survive. Such things are expected in the short term. In the medium and long terms, acquisitions are expected to be seen on a larger scale around the country and with larger market players. The market will become even more fragmented and centralized, with a few companies able to push it in different directions. This can have both advantages and disadvantages for local consumers, and the role of the government will be incremental so that the new larger market players do not take advantage of their dominant position, he added.

![[Interactive]: Economic overview - May 2025](https://media.vneconomy.vn/400x225/images/upload/2025/06/07/8c790d03-e712-4985-a60e-67d103a25506.png)