Many East Asia and Pacific (EAP) countries, including Vietnam, have been using monetary policies to support economic recovery but obstacles remain, World Bank (WB) experts said at an online webinar entitled “The Economics of COVID-19 in Developing East Asia and Pacific” on November 24.

In order to face the effects of the pandemic, EAP countries have facilitated access to credit to help individuals and to restore the economy in each country. Embargo measures in EAP countries have been gradually lifted in a uniform and transparent manner to avoid destabilizing the market. “Countries in the region need to strengthen their solvency framework to create favorable conditions for businesses to get out of debt and settle debt,” said Mr. Ergys Islamaj, Senior Economist, East Asia & Pacific Chief Economist Office, at the WB.

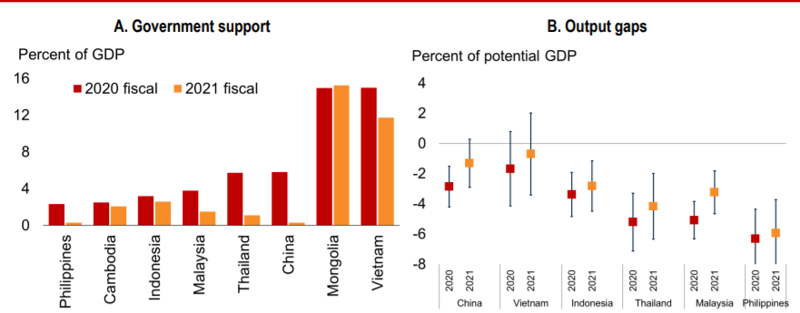

Prolonged economic hardship is limiting the ability of governments to provide economic assistance to EAP countries. As budget constraints across regions began to tighten, fiscal support in the region fell from an average of 7.7 per cent in 2020 to 4.9 per cent in 2021, and economies are still operating below their potential. However, as consumer price growth remains within the target set by central banks in most EAP countries, monetary policy remains supportive, unlike in several other emerging markets. This proves that EAP countries continue to make constant efforts to strengthen their economies following the severe impact of the pandemic.

Key actions amid Covid-19 include cuts to policy rates and reserve requirement ratios, as well as new asset purchases in several countries. Interest rates have not been raised during 2021, unlike in some other emerging markets. In addition, there is still room in EAP countries to boost demand in the region through monetary policy. The strong recovery in some industries combined with external factors such as booming commodity prices and shortages in the supply of key production inputs have driven up import and producer prices.

Monetary policies in these countries should also include a combination of tools that target price as well as exchange rate stability, according to Mr. Islamaj. Boosting the credibility of central banks by assurances of independence and a commitment to price stability will help anchor expectations. Most EAP countries have increased the level of foreign reserves since the onset of the crisis, but they appear to be low in Vietnam, Laos, and Myanmar. A more flexible exchange rate regime would allow greater monetary policy autonomy and relieve pressure on reserves.

However, EAP countries are still facing challenges in fiscal policies, with central banks likely to face trade-offs between continuing expansionary monetary policy and containing inflationary pressure. Mr. Agustin Samano, Economist of the Development Research Group: Macroeconomics & Growth, at the WB, noted that some countries still face difficulties, including expansionary monetary policy, which can lead to higher inflation, while increased borrowing to support fiscal expansion can lead to financial instability.

He suggested solutions for fiscal policies in EAP countries in the time to come, such as increasing the efficiency of expenditure and investment, introducing fiscal rules, and credibly committing to fiscal policies.

![[Interactive]: Economic overview - October 2025](https://premedia.vneconomy.vn/files/uploads/2025/11/07/a253c9cf41444727b5e16984e8d13a7b-27882.png?w=400&h=225&mode=crop)

Google translate

Google translate