PwC: Publicly-listed companies exhibiting caution in starting their ESG journey

Recent PwC Vietnam report reveals that publicly-listed companies in Vietnam remain cautious when getting underway with ESG.

Publicly-listed companies (PLCs) in Vietnam show a high level of commitment but appear to be quite cautious when embarking on their ESG journey, according to the recent “Public Listed Companies in Vietnam: The state of ESG Commitment and Sustainability” report released by PwC Vietnam.

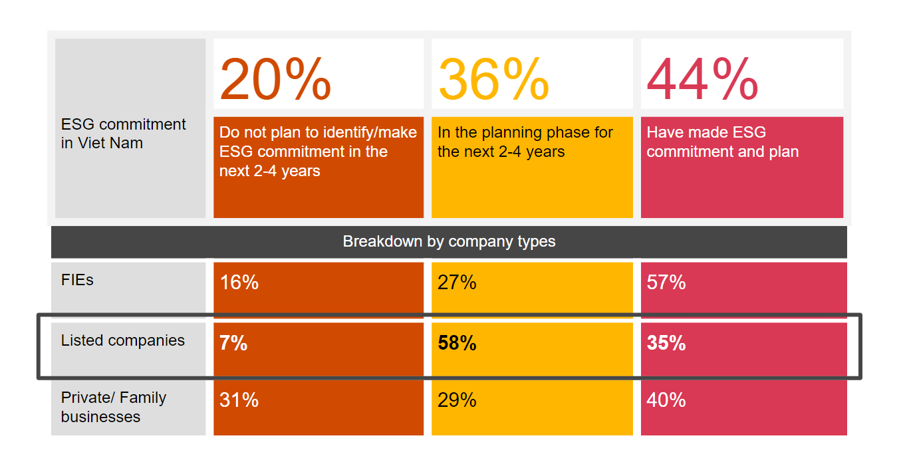

According to the ESG Readiness report conducted in 2022, the overall ESG commitment rate of PLCs in Vietnam stands at 93 per cent, surpassing the country’s average of 80 per cent. However, only 35 per cent of PLCs have established an ESG plan, which is considerably lower than the average of 44 per cent. More than half (58 per cent) of them are currently in the planning phase and will continue to be so for the next 2-4 years.

PLCs in Vietnam face a shortage of senior leadership dedicated to advancing ESG commitments. Approximately two-thirds (64 per cent) believe that their boards lack active involvement and transparent governance when it comes to the ESG agenda. Furthermore, nearly half (44 per cent) report the absence of a clearly defined ESG leader or Chief Sustainability Officer (CSO) to help drive and implement ESG initiatives within their organization.

This issue has emerged as a key challenge, as the Board of Directors (BOD) plays a pivotal role in overseeing ESG factors and integrating sustainability into decision-making and long-term growth strategies, to ensure the allocation and prioritization of the resources necessary for ESG implementation.

Out of the examined companies in Vietnam, 46 per cent reveal the responsibilities of their BOD regarding sustainability, 44 per cent disclose their sustainability governance structure, and a mere 8 per cent disclose the number of BOD members or management personnel who have undergone sustainability training. These percentages fall well below the Asia-Pacific regional averages of 84 per cent, 79 per cent, and 36 per cent, respectively. More notably, no PLCs in Vietnam disclose any connection between the remuneration of top executives and their performance in terms of sustainability.

“Although we acknowledge the advancement in the quality of sustainability reports by Vietnamese listed companies over time, there remains the need for continued improvement and increased awareness among PLCs in Vietnam, particularly in the area of green energy development and ESG interests,” said Mr. Nguyen Hoang Nam, Partner and ESG Leader, Assurance Services, at PwC Vietnam.

“Furthermore, collective commitment and cooperation between multiple stakeholders are required in order to achieve a lasting impact and responsible business environment in Vietnam. PLCs should proactively integrate ESG principles into organizational operations, leveraging their well-established frameworks and resources. At the same time, government bodies and regulators should develop clear policies to facilitate ESG progress, along with detailed guidance on ESG reporting measures.”

With the increasing demand for information, companies are constantly challenged with how to achieve balanced reporting that meets the needs of their various stakeholders. Balanced reporting will empower management and stakeholders with the information they need to effectively allocate capital and make choices. In addition, companies are faced with the rapidly changing landscape of ESG reporting, which encompasses numerous dynamic elements, including standards, frameworks, laws, and regulations.

PwC has recommended several steps that PLCs could take to tackle these challenges. Understanding your company’s purpose, wider ESG strategy and reporting aspirations as well as their interconnectivity is a good starting point to achieve balanced and comprehensive reporting. Good quality data is also imperative to present information to decision-makers in a useful way. Collecting and verifying information is hard, so companies need to think about systems, not just reports.

Moreover, the integration of ESG into business strategy, risk management processes, and performance measurement through better reporting can bring cost savings and generate long-term value creation for PLCs.