Solid prospects for apartment segment

Though still to escape the woes, recovery beckons in Hanoi and HCMC’s apartment markets.

The apartment segments in Hanoi and Ho Chi Minh City both faced difficulties in the first quarter of 2023 but also saw many positives.

According to Savills, though some recent policy and bright spots have provided positive prospects regarding long-term demand, the Hanoi apartment market remains quiet.

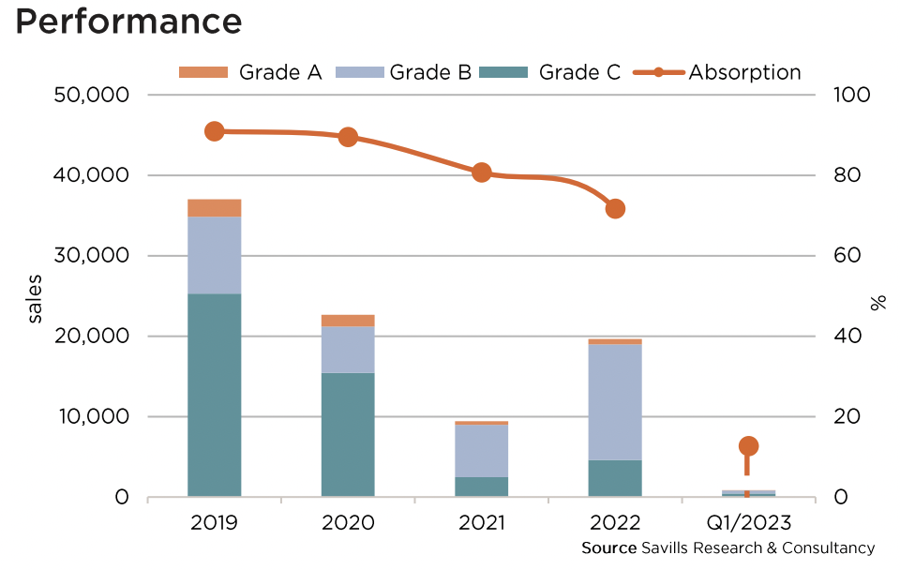

In particular, the primary stock of 19,483 units was down by 4 per cent quarter-on-quarter and year-on-year. New supply of 2,040 units came from two new projects and the next phases of two existing projects, down 30 per cent quarter-on-quarter and 27 per cent year-on-year. Developers have struggled to secure funding, while inflation and high interest rates pressure performance.

In 2023, nine new launches and the next phases of two projects will add 7,000 units. Amended laws are expected to give the residential market in general room to grow. From 2024 onwards, approximately 86,500 units will enter from 98 projects.

In Ho Chi Minh City, financial difficulties have put a lot of pressure on the apartment segment but also accelerated progress at many large projects.

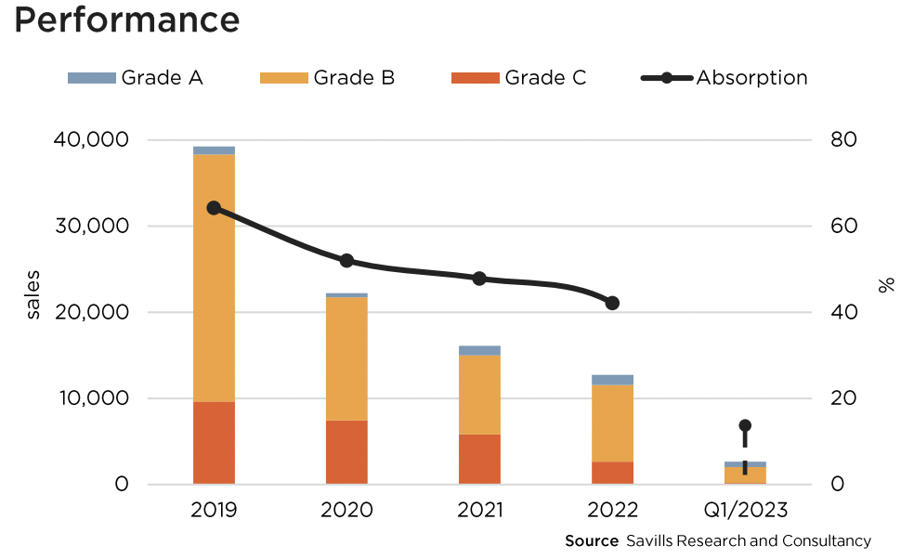

New supply fell 25 per cent year-on-year. The next phase of five existing projects delivered 875 units and two new projects had 735 units. Sales weakened further to 865 units, falling 38 per cent quarter-on-quarter and 71 per cent year-on-year, with new supply holding a 43 per cent share. The quarterly absorption of 13 per cent was down 4 percentage points (ppts) quarter-on-quarter and 60 ppts year-on-year, as demand for affordable units went unmet amid largely upscale stock.

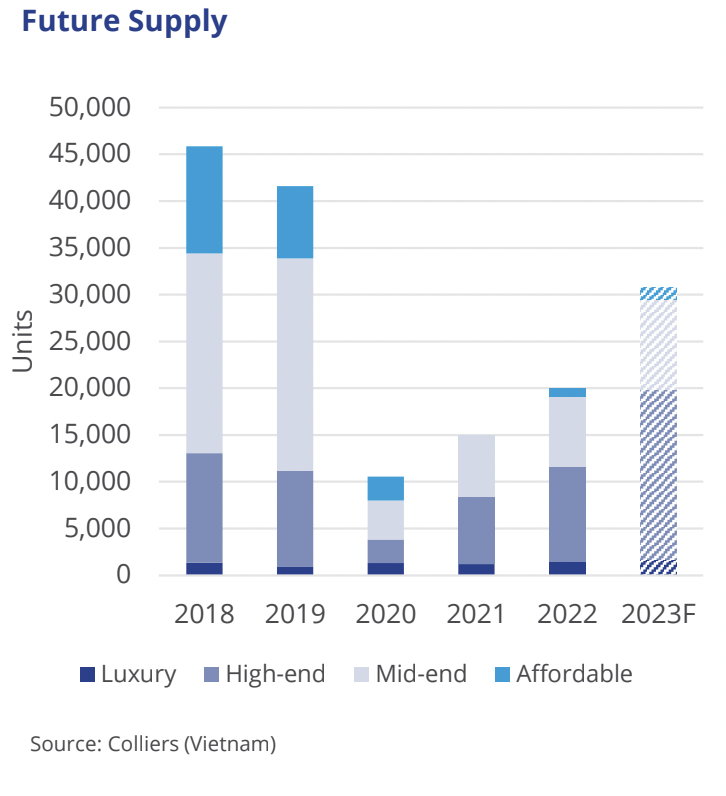

By the end of the year, 9,000 additional units are expected. By 2026, 137,540 units will enter from 186 projects. Though several projects have not confirmed their grade, developers are showing interest in affordable products to cater to demand.

The Colliers’ report also noted that in the first quarter were difficulties and challenges relating to credit control, high interest rates, poor liquidity, strict inspections and reviews of projects and developers, and unresolved legal difficulties that put great pressure on the apartment market.

The market in Ho Chi Minh City in the beginning of the year was also relatively quiet, with purchasing power continuing to decline despite landlords offering high discounts. Demand for apartment ownership is still low due to financial issues and poor liquidity. In the face of the difficulties in the current market, many developers are still observing and postponing the sales phase of new projects or the launch of new stock.

The asking price of apartments in Hanoi also include discounts and incentives but remain beyond the affordability of most buyers with actual demand. In addition, the fact that Hanoi is promoting investment in and the synchronous development of infrastructure, increasing connectivity between the central area and districts, along with the fact that projects are increasingly positioned in the higher segment, will be a lever for increased selling prices in Vietnam’s capital.

The recovery of the apartment market requires macro adjustments from the government and specific policies that directly affect both customers and developers. Currently, the Prime Minister has established the Prime Minister’s Working Group and directed ministries, branches, and localities to perform tasks and solutions in the short term as well as in the long term to promote the safe, healthy, and sustainable development of the real estate market.

The market will prosper and recover with support from the government and efforts from businesses. In addition, real estate merger and acquisitions (M&As) are forecast to increase sharply from the second quarter of 2023 in the context of prolonged capital, procedural, and legal difficulties for domestic developers.

Under the government’s investment policy, the apartment market will be prioritized to develop the mid-end condominium sector and social housing for low-income earners, to improve people’s lives and offer safe accommodation. Demand in these two segments has been quite high in recent times but supply remains limited.