Timo Digital Bank named ‘Fastest Growing Digital Bank’ by The Global Economics magazine for second year in succession

Bank recognized for use of technology to grow and ensure sustainable development during challenging times.

Due to the impact of the Covid-19 pandemic, 2021 has been evaluated as a difficult and challenging year, but has also created momentum for the digitalization of society as a whole and especially the banking and finance sector. As the pioneer and leading digital bank in Vietnam, Timo Digital Bank has shown its agility in rebranding by focusing on leveraging technology, upgrading its core banking system, and expanding its ecosystem for sustainable development. These efforts have helped it overcome this difficult period. Timo was honored to be the only Vietnamese representative named “Fastest Growing Digital Bank” for two consecutive years.

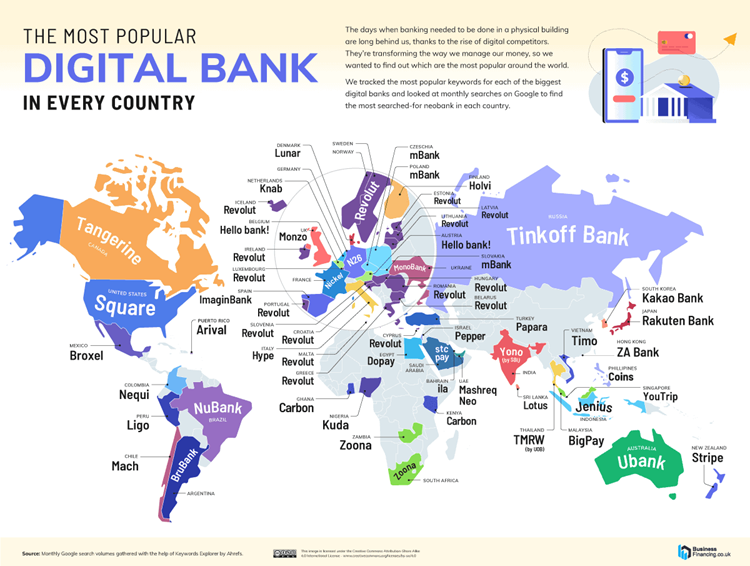

Vietnam marked its early arrival in the digital banking market with the appearance of Timo in 2015. Now is a “golden” time for Vietnam’s banking and financial services industry to make breakthroughs and innovations. The high penetration of digital payments has sped up traditional banks’ digitalization process, and Vietnam is fast becoming the only country in the region to rival Indonesia as a destination for investment in consumer-focused startups.

According to reports from UOB, PwC Singapore, and SFA, total investment in Southeast Asia’s fintech sector in the first nine months of 2021 was three times higher than in all of 2020, reaching a record $3.5 billion. Of this, Vietnam is ranked third in FDI fintech attraction, accounting for 11 per cent of combined capital in the region. A report from Findexable also put two large Vietnamese cities on a list of leading fintech hubs in the Asia-Pacific region. Accompanying the increased FDI in the fintech market and digital banking in Vietnam, the explosion of technology and the increasing demands of customers is bringing Vietnam’s target of having ten unicorns by 2030 closer.

Recognizing the opportunity for Vietnam’s digital banking market, many new players have participated in the “digitalizing race”, along with the participation of traditional banks, bringing about an exciting and fierce market. Competitive pressure has emphasized the importance of building customer trust and confidence when it comes to digital financing services.

At Timo, we are building a modern banking service that is putting customer demands at the heart - one that is easily accessible, convenient, and relevant, and valuable to our customers. Timo’s app has been innovated with features like TimoPay by Link, and Smart History, allowing recipients to respond to transactions like a social networking platform, integrating different financial needs such as insurance and investment. Timo is driven by making the lives of its customers better and more prosperous. During the difficult time of Covid-19, TimoPay by Link has provided an easy, convenient and free way to send money to anybody in need without the hassle of asking for the bank details. This is an impressive step that Timo has taken, bringing itself closer to the goal of becoming a social bank.

With a long-term and sustainable development strategy, Timo is focusing on expanding its partner ecosystem, both in the financial and non-financial sectors, to reinforce the connection with customers at every “touchpoint”. With a strategy of “standing on the shoulders of giants”, Timo achieved unparalleled customer outreach and increased its brand recognition by opening hangouts in association with leading brands like 7-Eleven and McDonald’s. Recently, it has cooperated with South Korea’s leading securities company, NH Investment & Securities, to develop more diversified integrated financial solutions, helping it become a “financial partner” and offering a digital banking app that covers all financial needs.

“From Timo’s pioneering efforts, Vietnam’s digital banking scene has experienced significant changes,” said Mr. Henry Nguyen, CEO of Timo Digital Bank. “Timo needs to thrive for the better in order to compete and maintain our standing. Beyond the concept of a traditional bank, we aim to develop into an ecosystem that covers every aspect of our customers’ daily lives. In the near future, banks will no longer play a key role in controlling their customers’ finances, and instead will be a platform to assist them performing financial-related tasks.”

Covid-19 has sped up the expansion of the digital banking sector in Vietnam. Financial inclusion is definitely one of Timo’s main missions. This means developing and applying the latest technologies to serve a larger segment of the population and be able to do so in a low-cost way. Offering no-cost banking services to all of Timo’s customers means there is one less barrier for them to perform electronic and cashless transactions and therefore be part of the rapidly growing digital economy. In order to achieve this, a big part of Timo’s work is to educate and provide access to basic banking services.