Transforming Digital Banking: Vietnam’s approach and the challenges

Recent Backbase report sheds greater light on the digital transformation landscape.

Backbase, a global leader in interactive digital banking platforms, has released an IDC InfoBrief report focused on the Asia-Pacific region entitled “Accelerating Customer-Centric Transformation through a Balanced Approach of Build and Buy - A Collaborative Path towards Sustainable Digital Banking Architecture”. The report reveals that 55.7 per cent of Chief Information Officers (CIOs) in Vietnam tend to support the “application and building” approach to manage costs and enhance the ability to bring products to the market.

Based on detailed data collected from 125 banks and 316 information technology (IT) directors in the Asia-Pacific region, the report sheds light on the digital transformation landscape. Key findings include the fact that out of medium and large-scale banks in Asia-Pacific, 65 per cent opt for internal development for digital transformation, but 70 per cent of these projects fail due to internal efforts being time-consuming and inefficient.

Digital experiences in numerous Asia-Pacific banks are below expectations, as most have yet to fully leverage the benefits of digitization. The disconnect between banks and customers is becoming increasingly evident. In Vietnam, 55.7 per cent of IT directors desire the application and building approach for digital banking transformation, higher than the Asia-Pacific average of 48 per cent.

Real-world examples from the IDC InfoBrief report reveal that a tier-1 bank in Vietnam invested heavily over two years to build its platform, while another tier-similar bank achieved comparable results in half the time by adopting the application and building strategy.

The leading challenges faced by Vietnamese organizations in the digital transformation journey are costs (57 per cent), national infrastructure (39 per cent), and data security (34 per cent).

Interestingly, the report highlighted that 80 per cent of high-budget (over $10 million) internally-built digital interaction platforms perform poorly and do not yield the desired return-on-investment for digital initiatives.

“Vietnam currently ranks second globally in terms of the population using digital banking applications,” said Mr. Riddhi Dutta, Vice President for Asia at Backbase. “With around 30 million domestic digital banking users and 90 per cent of banking transactions managed through digital channels, banks need to innovate not only around customers but also at a high pace and large scale.”

The report highlights a significant gap between banks and customers, with banking services often perceived as similar and lacking variety. Customers encounter issues navigating different interfaces, lack unified investment views, and face lengthy processes. The IDC InfoBrief stresses the effectiveness of the application and building approach, enabling faster market entry and differentiation, saving costs by 2.3-fold, and launching digital interaction platforms 40 per cent quicker than traditional methods.

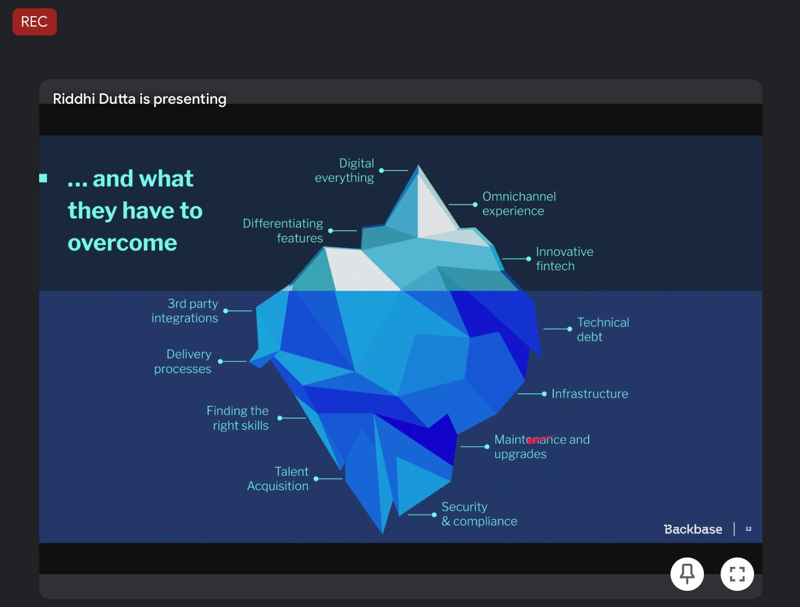

Mr. Ashish Kakar, Senior Research Director at IDC, highlighted the complexity arising from data layers, channels, features, and customer interaction journeys that need to be comprehensively managed and integrated, causing disruptions in internal deployments.

The IDC InfoBrief report showcases that the application and building strategy is widely accepted in the market. Notably, Techcombank, one of the top 4 banks in Vietnam by asset size, serves as a prime example of this approach. The bank’s self-controlled strategy for unique digital customer journeys and interactions has earned it high ratings on app stores. Additionally, two more Vietnamese banks, ABBANK and OCB, have announced investments in interactive digital banking platforms.