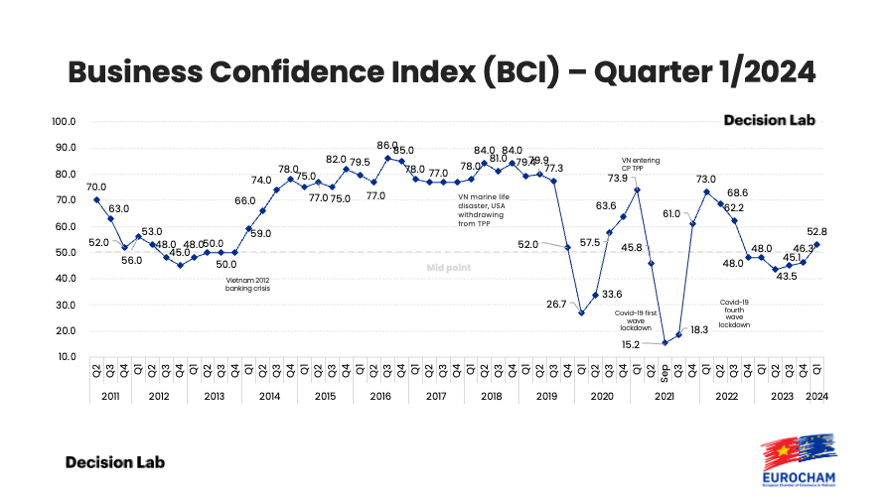

Vietnam on the Rise: European Businesses Signal Growing Confidence

EuroCham’s latest Business Confidence Index reveals surging optimism within the European business community, positioning Vietnam as a favored investment destination. Yet, regulatory hurdles need tackling for the country to reach its full potential.

European businesses are signaling renewed confidence in Vietnam's economy. This resurgence in optimism is reflected in the European Chamber of Commerce in Vietnam's (EuroCham) first-quarter 2024 Business Confidence Index (BCI), which reached its highest level since Q3 2022.

"The positive results underscore [that] Vietnam is seen as a dynamic market with promising opportunities," says Dominik Meichle, Chairman of EuroCham. This uptick in sentiment indicates Vietnam's rising appeal to investors, with further room to enhance its attractiveness.

An encouraging sign is the strong likelihood European businesses have of recommending Vietnam as a top investment destination. 54% of those surveyed rate their chances of recommending Vietnam highly. "The data paints a clear picture – investor optimism is steadily improving," notes Thue Quist Thomasen, CEO of Decision Lab.

Optimism Abounds, But Reforms Needed

European businesses see reasons to be optimistic about Vietnam's prospects, both short-term and long-term. A third of surveyed businesses are positive about their individual second-quarter outlooks. More significantly, half anticipate placing higher orders and generating more revenue in Q2 2024, and 40% plan to expand their workforce. Only 15% intend to cut spending, a marked decrease from 23% in the previous quarter.

This bullish short-term sentiment strengthens over the longer horizon, with 71% of respondents positive about their prospects in Vietnam over the next five years. Vietnam's skilled workforce remains a strong draw, with 75% of EuroCham members sourcing at least 76% of their staff locally.

However, regulatory hurdles remain a significant pain point. Over half of the businesses cite administrative burdens as a major obstacle to setting up and growing in Vietnam. Unclear regulations, work visa restrictions, and permit delays add costs and create uncertainty.

To further enhance the investment climate, 37% of businesses urge streamlined procedures, and 34% call for greater clarity and consistency in laws, while 28% advocate infrastructure improvements. "Vietnam's economic potential is enormous, and addressing these regulatory challenges will boost both domestic and foreign businesses," emphasizes Meichle.

Sustainability Challenges & Regulatory Shifts

While Vietnam progresses on sustainability, European businesses find adaptation challenging. Low consumer interest, the struggle to balance cost and sustainability, confusing environmental regulations, and inadequate infrastructure are major obstacles.

Businesses are also closely watching several major regulatory shifts in the pipeline. Key areas include the Power Development Plan (PDP) VIII, pharmaceutical regulations, recent Land Law revisions, and potential developments in carbon border mechanisms, direct power purchase agreements, and data protection.

Navigating Headwinds

Recent global shipping disruptions have negatively impacted three out of five respondents, emphasizing the need for Vietnam to mitigate the effects of external risks on its economy.

Despite economic uncertainties, real estate headwinds, and supply chain risks, the data reveals European businesses are optimistic about Vietnam's prospects. The trend suggests the European business sector is prepared to seize opportunities in Vietnam while partnering to advocate for a more competitive and sustainable business environment.