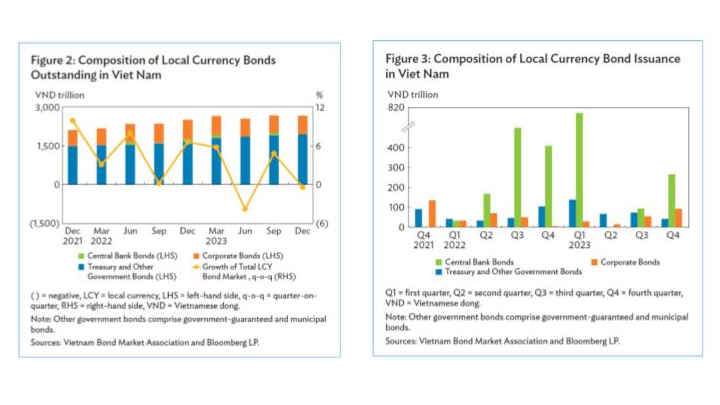

Vietnam's local currency (LCY) bond market experienced a slight decline in the fourth quarter of 2023, according to the Asian Development Bank's (ADB) Asian Bond Monitor report. The decline is attributed to a significant volume of central bank securities reaching maturity.

A total of $14.8 billion in central bank securities matured in the final quarter of 2023, while the State Bank of Vietnam (SBV) halted bond issuance in November due to rising overnight interbank rates stemming from liquidity adjustments within the banking system.

Government bond issuance also slowed, resulting in a modest 2% quarter-on-quarter increase in outstanding government bonds. Between December 1, 2023, and February 29, 2024, Vietnamese local currency government bond yields declined across most tenors amid uncertainties surrounding potential US Federal Reserve policy rate cuts. The SBV's decision to hold rates steady since July 2023 to support economic growth also contributed to the yield decline. According to Vietnamnet Global, the SBV has expressed its intention to maintain its current policy rate throughout 2024 to support economic growth, which came in at 5.1% year-on-year in 2023, below the government's 6.5% target.

Conversely, corporate bond issuance saw a 6.8% increase following a downturn in the previous quarter. This uptick is attributed to stricter government regulations on corporate bond issuance and lower bank deposit interest rates, which have bolstered investor sentiment following corporate bond market reforms.

Google translate

Google translate