Healthcare M&As growing in appeal

M&A deals in Vietnam’s healthcare sector have been flourishing and continued growth is predicted given the country’s changing circumstances

The American International Hospital (AIH) recently announced it has reached a comprehensive strategic cooperation agreement with Singaporean private medical provider the Raffles Medical Group (RMG). Under terms effective from October, RMG will acquire a significant share in AIH from the merger and acquisition (M&A) deal and become a strategic partner in management and operations, with the aim of developing high-quality healthcare in Vietnam. “Through this strategic cooperation, AIH will have an additional internationally-experienced partner to ensure the quality of medical expertise as well as gain a competitive advantage in providing high-quality healthcare services in Vietnam,” said Ms. Nguyen Thi My Linh, CEO of AIH.

Deals done

The latest update to PwC’s Global M&A Trends in Health shows that pharmaceuticals, life sciences, and healthcare services continue to attract substantial investor interest, and this is expected to continue during the remainder of 2023. “Post-Covid, healthcare emerged as one of the key sectors vital to all countries as individuals began to focus and place more emphasis on their health status,” said Mr. Ong Tiong Hooi, Partner and Transaction Services Leader at PwC Vietnam.

Earlier, the Tam Tri Medical Joint Stock Company (TMMC Healthcare) acquired the Binh An General Hospital in central Quang Nam province, renaming it Tam Tri Quang Nam General Hospital. Following this deal, TMMC Healthcare then acquired another hospital, the Van Phuc Saigon Hospital (VPSG) in Ho Chi Minh City. Japan’s ASKA Pharmaceutical Co., Ltd, meanwhile, has plans to increase its stake in the Ha Tay Pharmaceutical JSC (DHT).

Vietnam’s healthcare sector has seen a number of M&A deals in recent times, including between Traphaco and Daewoong from South Korea, Mekophar and Nipro Pharma from Japan, Imexpharm and the SK Group from South Korea, Pymepharco and STADA Service Holdings B.Vor from Germany, and Hataphar and ASKA Pharmaceutical from Japan, among others. Several leading Vietnamese healthcare enterprises, such as Hau Giang Pharmaceuticals (DHG), Domesco (DMC), Traphaco, and Imexpharm, all have foreign shareholders, some of whom hold over 51 per cent control or have taken over the entire business.

These M&A deals with foreign enterprises have facilitated the development of Vietnam’s healthcare businesses. For instance, at Traphaco, with Daewoong as a strategic shareholder since 2018, the company has shifted its business strategy to focus on technology transfer and international market expansion. “The presence of the South Korean shareholder has brought about significant change,” said Mr. Tran Tuc Ma, General Director of Traphaco. “The first and most substantial change is in vision and strategy, shifting towards a more focused direction on new drugs.”

According to Mr. Andy Ho, CEO of VinaCapital, the manufacturing of medical equipment and pharmaceuticals as well as drug distribution and medical services in Vietnam are becoming attractive to foreign investors. With a rapidly-growing middle class, an aging population, a number of challenges facing the public hospital system, and increased awareness about the importance of good quality healthcare, the opportunities for foreign firms are becoming clear.

Advantages in terms of inexpensive labor and low production costs have also resulted in Vietnam’s healthcare companies becoming increasingly popular among foreign investors. These investors often set up production lines by licensing or buying shares in local enterprises, then export the products they produce to global markets.

In addition, the government has set an ambitious target of Vietnam becoming a high-value pharmaceutical production center, earning $1 billion annually from pharmaceutical exports by 2030. “Given the increased levels of disposable income in recent years and projected numbers going forward, Vietnam’s healthcare sector is being closely watched by various financial investors and strategic investors as they broaden their presence across Southeast Asia,” Mr. Hooi said.

Appealing advantages

The rapid development in Vietnam of both awareness about the importance of quality healthcare and the ability to pay for it, coupled with insufficient local healthcare services, has created a lot of space for foreign enterprises to invest and grow their presence in Southeast Asia. M&As are one way that foreign enterprises can capitalize on the opportunity, based on a keen understanding of the sector and Vietnam’s free trade agreements.

According to the Ministry of Health, some 40,000 Vietnamese people spend approximately $2 billion each year traveling abroad to access high-quality medical services. Most of this travel is due to higher technical specialities and care provided by healthcare providers abroad, when it is deemed that such care is not available in-country.

“As most healthcare assets we see on the market are still being run by the founding shareholders, it is envisaged that with the introduction of foreign strategic shareholders we will see increased technical development, investments into research and development (R&D), and improved medical offerings and service levels that are customized and in tune with the development of the country,” Mr. Hooi noted. “In turn, this would lead to better customized service levels and care provided in-country and also increased competition in the sector.”

Similarly, Ms. Nguyen Thu Cuc, Chairman of the Board Director at the Thu Cuc Medical & Beauty JSC, said the potential for private healthcare in Vietnam is huge. With 100 million people, rising incomes, more intellectuals, and growing demand for high-quality medical services, impressive growth is practically inevitable. Many M&A transactions in the healthcare sector have been reported in recent years, with many showing signs of success, and others are expected.

New drivers needed

Despite the positive signs, analysts believe the market needs more drivers to facilitate M&A deals in the time to come, with legal reform and market openness being among the key areas of interest. Mr. Hooi said that Vietnam’s healthcare sector suffers from a number of challenges, primarily a lack of personnel compared to global averages. The country is also behind in the number of nurses and physicians per population, which restricts the ability for hospitals and clinics to deliver the right level of care and also to scale up. “The sector will need support in being able to train and upskill new and existing personnel to meet ever-increasing demand in the sector, and investing more in these areas will help facilitate growth,” he added.

Vietnam also needs more active R&D activities in the healthcare sector. Though R&D spending in the sector, especially in the pharmaceutical industry, has improved since 2017, it is still much lower than the global average. A survey of domestic pharmaceutical companies, conducted by the Health Strategy and Policy Institute (HSPI) in 2020, found that 61 per cent of enterprises spend less than 5 per cent of their revenue on R&D. “This restricts competitiveness in the sector and slows down its development,” said Mr. Hooi. “In order to foster R&D, the government may need to consider creating incentives to provide funding for public research and address the gap.”

In addition, enhancing the openness of the healthcare market is necessary. Mr. Hooi said the EU-Vietnam Free Trade Agreement (EUVFTA) is a good example of how Vietnam can boost the availability of high-quality medications for Vietnamese consumers while also attracting and increasing the profitability of EU companies in the sector through lower tariffs and allowing these companies to import pharmaceuticals into Vietnam and establish 100 per cent foreign-owned companies.

“With the pharmaceutical sector being a highly complex and professional field, the implementation of a standard due diligence process in healthcare M&As could create invisible barriers for potential investors,” Mr. Hooi said. “These include the uncertainty in the legal framework in Vietnam coupled with the intricate, overlapping web of specialized legal provisions on medicine and pharmaceuticals as well as limitations in market approach.”

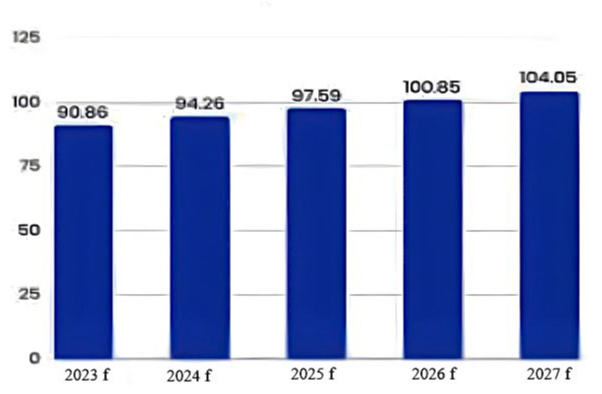

As for the future, optimism surrounds healthcare M&As. As forecast by Fitch Solutions, the anticipated size of Vietnam’s healthcare sector of $14 billion coupled with rising disposable income per capita will give rise to a growing healthcare base. This could be achieved via the emergence of new players or the eventual consolidation of selected assets within the country.

According to Mr. Hooi, given the rapidly-evolving healthcare sector, various forms of partnerships and cooperation are now imperative, not optional, to stay ahead of the game. There are various forms of cooperation for Vietnam’s healthcare stakeholders to consider, such as hospitals choosing to expand organically or via acquisition or strategic partnerships, especially in areas that are traditionally not covered by hospitals, such as teleconsultation and mHealth, wellness services, home care, and palliative care.

Hospitals, tech companies, and the government could cooperate to transform care delivery, while local hospitals, both public and private, may consider partnering with foreign hospitals with well-established brands, to collectively deliver consumer-centered healthcare. Expansions into new healthcare services via leveraging developed markets, such as elderly care and other services presently unavailable in-country, are also a possibility.