FPT Long Chau, a member of the FPT Digital Retail JSC (FPT Retail), officially announced the opening of its 1,000th store in Ho Chi Minh City in early December, marking an impressive journey in exceeding its network expansion plans by 125 per cent in 2022. The total revenue of FPT Long Chau reached VND6.56 trillion ($276.9 billion) in the first three quarters of 2022, up 2.6-fold over the same period of 2021, with more outlets opening soon.

“Expansion is still our main strategy in 2023, with 400-500 new stores expected to open,” said Ms. Nguyen Bach Diep, Chairwoman of the Board of Directors of FPT Retail and General Director of FPT Long Chau. “We are still continuing to expand our network, increasing the coverage of the FPT Long Chau pharmacy chain in the country to reach more and more customers.”

Rapid moves

Similarly, Pharmacity now has 1,100 stores in Vietnam and views its 1,100th store as a milestone reflecting its role in the pharmacy market. It is well-positioned to capture growth as Vietnam moves to its next phase of development. Pharmacity also announced a partnership with RELEX Solutions to improve its overall inventory management and ensure customer satisfaction. According to Ms. Tran Tue Tri, CEO of Pharmacity, the partnership will enable Pharmacity to anticipate product demand and optimize inventories to ensure that customers can always access essential products when and where they need them.

After adjusting store numbers as well as business orientation, An Khang Pharmacy, a subsidiary of the Mobile World Investment Corporation (MWI), is now focusing on increasing its market share and store numbers around the country. Mr. Doan Van Hieu Em, CEO of MWI, said An Khang Pharmacy will speed up the business activities of its nationwide chain to boost both revenue and store numbers.

With three major pharmacy chains - FPT Long Chau, An Khang, and Pharmacity - Vietnam’s pharmacy market still has space for development and is expected to see the entry of new chains. The Dr. Win JSC under the Masan Group and Viettel Commerce under Viettel are currently in the process of building their own chains, preparing lists of medicine, functional food, and medical supplies and seeking investors.

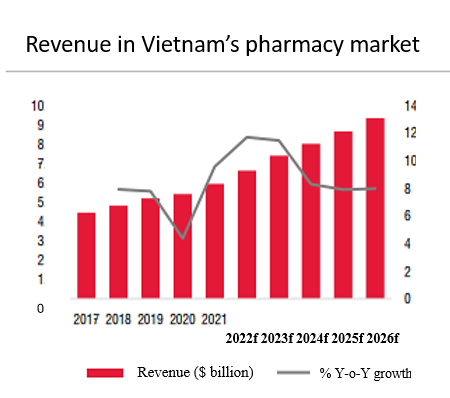

According to a report released in November by TechSci Research, Vietnam’s pharmacy retail market stood at $7.45 million in 2021, with an expected compound annual growth rate (CAGR) of 6 per cent during the 2021-2027 period. The TechSci researchers attribute the growth prospects to the aging of Vietnam’s population and the emergence of retail companies in the market.

Potential on offer

Vietnam’s pharmaceutical market is fiercely competitive, encouraging many pharmaceutical chains to expand. Ms. Diep said there is significant space in the pharmacy retail market and the number of outlets belonging to chains accounts for only a small proportion, at 3,000 out of 50,000 in total. “This is a major opportunity for FPT Long Chau’s pharmacy chain to continue to grow and develop,” she said.

The population aged over 65 stands at 7.6 million and the proportion of this age group is forecast to reach 17.5 per cent by 2049, according to the Vietnam Population Forecast released by the General Statistics Office (GSO). Its aging population will eventually increase demand for medications and other healthcare products in Vietnam, while factors such as increasing incomes and rising urbanization will also bolster the development of the country’s pharmacy market.

“The Global Use of Medicines 2022” report from IQVIA Institute notes that Vietnam is among 17 countries in the group of Pharmerging Markets, which have the fastest-growing pharmaceutical markets in the world. Pharmerging Markets are divided into three subgroups, with Vietnam in the third group of 12 countries. With growth of 14 per cent, Vietnam is behind only Argentina and Pakistan.

The report also predicts that Vietnam’s pharmaceutical revenue is expected to reach $7.51 billion by 2025, accounting for 1.78 per cent of GDP and 32.2 per cent of healthcare spending at a CAGR in 2020-2025 of 8 per cent. As its economy is moving towards a period of high inflation, investors may be concerned about the impact of input prices on the profitability of the pharmaceutical market.

SSI Securities has pointed out, however, that the pharmaceutical business is less affected by a high inflation environment, and input costs are more stable than in other industries. With stable demand over the years and stable valuations due to a concentrated shareholder structure and frequent merger and acquisition (M&A) demand, the pharmaceutical industry is a sound choice for investors in times of market volatility.

Though the proportion of chains remains quite small, the ambitious plan of the top three chains is to bring the total number of outlets in chains to 7,300 by 2025, for a 16 per cent market share and helping revenue increase more than actual demand over the next 2-5 years.

The main distribution channel for medicines in Vietnam is over-the-counter (OTC) and ethical drugs (ETC). According to VietnamCredit’s Overview of Vietnam’s Pharmaceutical Industry, ETC channels account for 70 per cent of the medicine market while OTC channels hold the remaining 30 per cent.

The expansion of the OTC channel is expected to help reputable pharmaceutical retailers in Vietnam strengthen their position, ensure their competitiveness, and avoid any negative effects from policies and guidelines in the health industry. “With nearly 50,000 private drugstores nationwide, the space is huge,” said Ms. Diep.

Research conducted by the EU-Vietnam Business Network found that 80 per cent of Vietnam’s population buy drugs to treat illnesses on their own rather than consulting a doctor. “In retail, the customer experience is still the deciding factor, so every innovation revolves around this,” Ms. Diep said. FPT Long Chau will therefore focus on new technologies such as the application of artificial intelligence to understand customers.

Large pharmaceutical players are well aware of the new market entrants but are ready for the challenges to come. “New competitive pressure always appears, and more competition means more difficulties, but we accept that problems will come and the solution is to be the best,” she added. The market also receives support from policymakers. “The government accompanies and supports businesses by increasingly loosening policies, offering tax incentives, and creating conditions for businesses to operate and dedicate themselves to the country.”

Google translate

Google translate