PM urges FTSE Russell to support Vietnam's emerging market push amid key reforms

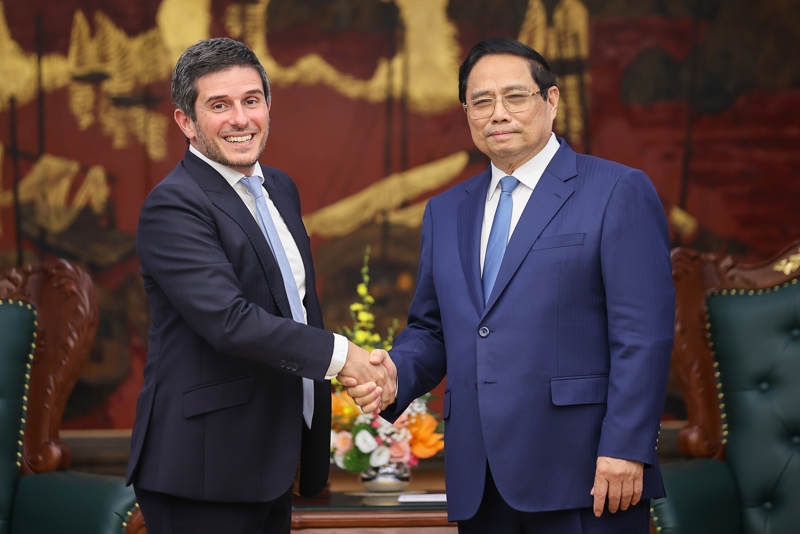

The call came during the Prime Minister's meeting with Mr. Gerald Toledano, FTSE Russell’s Global Head of Equity and Multi-Asset, who is leading a delegation to assess Vietnam's capital markets for a potential reclassification.

Prime Minister Pham Minh Chinh has urged global index provider FTSE Russell to accelerate its support for Vietnam’s bid to achieve emerging market status, stressing the need for a transparent and stable market to drive capital mobilization.

The call came during the Prime Minister's meeting in Hanoi on July 17 with Mr. Gerald Toledano, FTSE Russell’s Global Head of Equity and Multi-Asset, who is leading a delegation to assess Vietnam's capital markets for a potential reclassification, according to a report from the Government News.

The Prime Minister specifically requested FTSE Russell's advisory support on strengthening the legal framework, modernizing infrastructure, implementing smart governance, and developing a high-caliber workforce. He also asked for assistance in attracting global capital flows and realizing Vietnam’s ambition to establish an international financial center.

In response, Mr. Toledano affirmed FTSE Russell's firm commitment to supporting Vietnam's push to upgrade its stock market from "frontier" to "emerging". He pledged to partner with the nation on its long-term development goals, including its Vision to 2045 for economic prosperity, and committed to actively sharing information about Vietnam’s reforms and progress with the global investment community.

Mr. Toledano highlighted the impressive results of Vietnam's market development, noting its stock market now boasts the highest liquidity in the ASEAN region, surpassing both Thailand and Singapore.

He praised Vietnam's determination and credited critical reforms—such as developing a roadmap for a Central Counterparty (CCP) mechanism—as key factors positioning the economy for sustainable growth and supporting its case for reclassification.