SHB to issue VND5,000 billion in bonds by late 2024 and Q1 2025

First tranche to offer VND2,500 billion ($100 million) to strengthen financial capacity and expand capital

To enhance safe and profitable investment opportunities for customers, as well as to strengthen financial capacity and expand mid- and long-term capital to support the economy, Saigon – Hanoi Commercial Joint Stock Bank (SHB) will issue bonds worth VND5,000 billion ($200 million). The first tranche will offer VND2,500 billion ($100 million).

Bank bonds: Leading the market

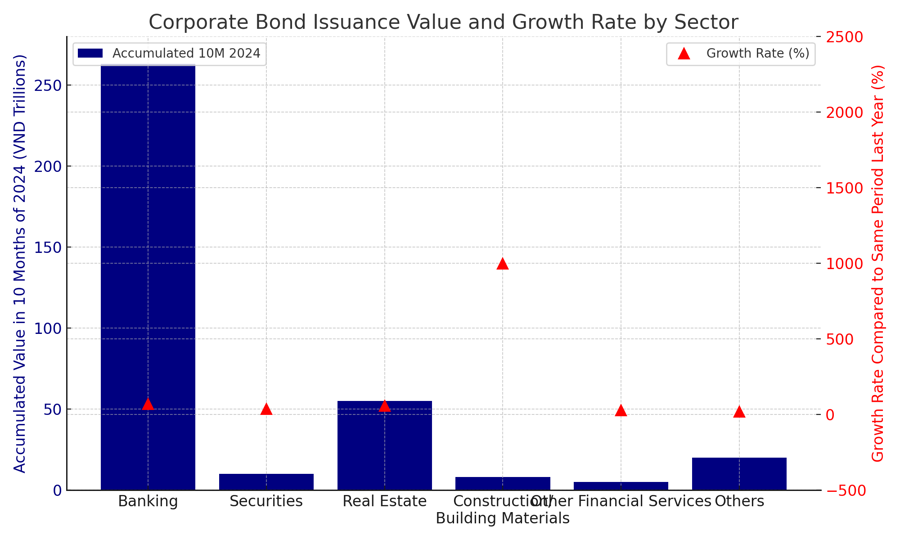

In a recent bond market report, analysts at MBS Research observed a surge in corporate bond issuance during Q4/2024, fueled by businesses' recovering capital demand and active expansion efforts in production and operations, supported by the broader economic recovery.

From January to October 2024, the banking sector had the highest bond issuance value, approximately VND263,000 billion ($10.52 billion), accounting for 72 per cent of the total market. This marked a 154 per cent increase compared to the same period last year.

MBS experts noted that banks are expected to continue ramping up bond issuance to supplement their lending capital. Credit growth across the banking system reached 10.08 per cent in the first 10 months of 2024, surpassing last year’s rate of 7.4 per cent. Credit growth is forecasted to accelerate further in the last two months of the year, driven by robust recovery in production, exports, and services.

Associate Professor Dr. Dinh Trong Thinh, a banking and finance expert, highlighted the resurgence of the bond market, mainly led by issuances from commercial banks. He emphasized, “Bonds issued by banks are used to supplement mid- and long-term capital. This is a safe investment channel, regulated by government authorities, with guaranteed principal and interest payments similar to savings accounts.”

SHB expands investment opportunities for customers

SHB’s upcoming bond issuance aims to provide safe and effective investment options for customers while boosting its financial capacity. The first tranche will offer VND2,500 billion ($100 million) in bonds, open for registration from December 26, 2024, to February 28, 2025. This tranche is implemented under Resolution 21/2024/NQ-HDQT, detailing SHB's bond issuance plan to the public.

By November 30, 2024, SHB’s total assets stood at VND708 trillion ($28.32 billion), with outstanding credit balances nearing VND522 trillion ($20.88 billion), marking an 18 per cent increase. Its capital adequacy ratio (CAR) is 12 per cent, adhering to Basel III standards since 2023. With charter capital of VND36,629 billion ($1.46 billion), SHB remains among the top five largest private commercial banks in Vietnam.

Staying committed to sustainable and efficient development, SHB continues to elevate its management standards to international levels while maintaining operational stability in Vietnam’s banking sector. It has tightened credit quality control, strengthened debt recovery efforts, and supported customers in overcoming challenges during their recovery journeys.

Dr. Dinh Trong Thinh further affirmed SHB's leading position as one of Vietnam's top five private banks, recognized by domestic and international credit rating agencies for its robust risk management practices. SHB’s VND5,000 billion ($200 million) bond issuance underscores the bank’s credibility and financial strength, offering investors a secure and profitable investment channel.

As part of its comprehensive transformation strategy from 2024 to 2028, SHB is fostering innovation and leveraging technology to optimize internal operations while delivering modern, convenient solutions to customers. This focus has resulted in an industry-low cost-to-income ratio (CIR) of 24.68 per cent.

SHB aims to become the most efficient bank, the most favored digital bank, the leading retail bank, and a top provider of financial solutions for strategic corporate clients across public and private sectors, prioritizing green development. Driven by its core values, SHB remains dedicated to creating and spreading positive impacts for communities and society, contributing to Vietnam’s progress into a new era.