Vietnam's Economic Rebound Hits Its Stride, But Risks Remain - Prime Minister's Cabinet Meeting in April Concludes

Government Lays Out Comprehensive Revival Strategy Amid Signs of Recovery Taking Hold

Vietnam's economic resurgence is gaining momentum, but ensuring sustained and stable growth will require the government to skillfully navigate an array of challenges, from rising debt to supply bottlenecks and inflation pressures.

At a pivotal cabinet meeting on May 4, Prime Minister Pham Minh Chinh rallied his economic team around an ambitious 15-point action plan to put the recovery on a more durable footing while also addressing longer-term structural weaknesses.

The gathering, attended by deputy prime ministers, advisers and regional leaders, served as a comprehensive review of the country's progress nearly three years after the Covid-19 pandemic triggered a sharp downturn.

While welcoming improved economic data of late, PM Chinh warned that continued vigilance was required to solidify the gains and enable Vietnam to resume its once-breakneck development trajectory.

First among the government's priorities is deftly calibrating fiscal and monetary policies to deliver a shot of stimulus while keeping inflation firmly under control. PM Chinh called for "flexible, focused" fiscal spending paired with a "proactive, flexible" monetary stance.

Failure to provide sufficient support could imperil the still-tentative revival, especially in sectors like real estate and export manufacturing which have lagged the rebound.

Stoking Inflation Flames

Yet pumping too much demand into the system also carries dangers. While April inflation clocked in at 0.07% month-on-month, price pressures over the past year hit nearly 4%. For an export powerhouse reliant on cost competitiveness, such inflation could rapidly render its products uncompetitive on global markets.

To mitigate upside price risks, the premier directed officials to rein in state-dictated prices on public services and utilities. Tax and fee rebates should also be readied to ease cost burdens on businesses. Simultaneously, Chinh told the State Bank of Vietnam (SBV) - the central bank - to more proactively manage the dong's exchange rate to protect trade advantages.

A frothy real estate market was singled out for special remedial attention. After years of surging valuations and easy credit, real estate transaction volumes have slumped and developers face rising financial stress. "Healthy, safe development" of the property sector is needed, the PM cautioned.

Banking Sector Risks

Safeguarding the banking system as the real estate downturn plays out represents another critical challenge. Non-performing loans (NPLs) began "tending to rise" over recent months, warned the government, as real estate exposures soured. Unchecked, the bad debt overhang could metastasize into a broader credit crunch capable of snuffing out the fledgling recovery.

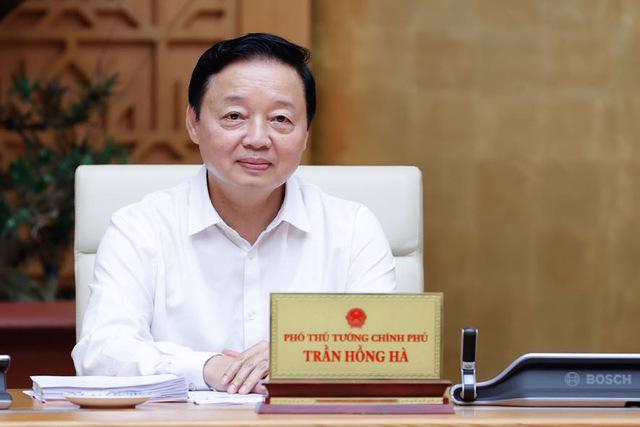

Based on the meeting readout, cleaning up the banking sector appears top of mind for policymakers. Deputy PM Le Minh Khai was tasked with spearheading "comprehensive solutions" to real estate woes and their financial contagion effects. This could entail taxpayer-funded bailouts or regulatory forbearance to nurse lenders back to health.

Promising Signs on the Ground

Even before this latest policy blitz, there were glimmers of economic life taking root. April data revealed industrial production leaping 6.3% year-on-year and exports up 15% to USD 61.2 billion as goods flowed more freely across reopened borders. The manufacturing sector, long a key engine for Vietnam's rapidly industrializing economy, accelerated 6.3% in April compared to a year earlier.

Premier factories continued ramping up headcounts and production runs. Northern provinces like Bac Giang enjoyed a 24% boom in factory output amidst a consumer electronics surge. Vibrant export activity enabled the January-April trade surplus to swell to $8.4 billion, a boon for reinforcing depleted foreign reserves.

Further brightening the outlook have been recoveries in the service economy and tax receipts, two areas badly battered by pandemic-related disruptions.

Retail sales rose 9% year-on-year in April as consumer mobility restrictions eased, while government coffers swelled 10% over January-April thanks to revived business activity and household consumption.

With inflation, debt, real estate and banking sector hazards looming, one policy lever providing relief is strong state finances. Tax receipts over the first four months reached $29 billion, a jump of over 43% compared to budget forecasts, according to official figures cited at the meeting. This allowed state spending obligations to be comfortably met thus far.

Public debt loads also remain relatively constrained for a developing economy. Vietnam's debts were described as "well below regulatory limits", giving policymakers some fiscal room to fund infrastructure and pro-growth initiatives. A $1.3 billion cache of unspent public investment funds was earmarked for "shovel-ready" capital works.

Turbocharging Growth Engines

Besides shoring up the prevailing economic model, the government signaled ambitions to press ahead with ambitious structural transformations.

Among the "strategic breakthroughs" singled out for acceleration were upgrading infrastructure, human capital and institutions. Clearing away bureaucratic bottlenecks was described as a top priority to foster a more dynamic, business-friendly climate.

Central to these efforts will be accelerating mega-projects like the north-south expressway aimed at connecting major commercial hubs. Another area up for streamlining is public investment mechanisms, where arduous state approval processes were blamed for snarling project execution.

Also under the reform microscope is fostering higher-tech and knowledge-intensive engines of future growth. Officials doubled down on plans to build domestic competencies in semiconductors and other cutting-edge fields like artificial intelligence.

Environmental Stresses

But modernization brings its own sustainability stresses. With long coastlines and low-lying agricultural heartlands, Vietnam is acutely vulnerable to climate threats like rising seas and extreme weather. Officials acknowledged the imperative of balancing industrialization with "green transformation" and developing circular economic models.

Yet, conflicting priorities remain. Even as the need for low-emission energy sources like wind and solar was touted, securing short-term power adequacy took precedence. The premier ordered bureaucratic obstacles stunting fossil fuel and coal power projects to be removed "to ensure adequate supply in all situations."

Greening initiatives like forest and water conservation were also accorded bandwidth. This followed a devastating drought and rash of wildfires over April which threatened agricultural production. Given the country's heavily rural economy remained leveraged to climate patterns, boosting ecological resilience was deemed imperative.

Talent Pipeline Woes

Yet human capital deficits threaten ambitions on multiple fronts. Severe skills shortages were frankly acknowledged, with the premier lamenting that "the capacity and responsibility of officials does not meet requirements."

This workforce inadequacy was flagged as perhaps the biggest constraint on realizing economic modernization and escaping the middle-income trap.

To narrow the gap, PM Chinh directed a top-down focus on technology training curriculums. Scientific research, semiconductor skills and digital capabilities all featured as priority areas. Incentives for private sector investment in staff retooling were also mooted, suggesting growing official attunement to labor market pressures.

The sense of urgency suffusing the five-hour meeting also reflected Vietnam's precarious perch in the development cycle. While still a radically transformed economy from the penurious nation it was mere decades ago, the threat of stagnation looms without unremitting policy discipline.

A tripling down on business deregulation, human capital upgrades and green economy incentives was stressed as vital for future dynamism.

PM Chinh also instructed the cabinet to improve analysis and forecasting capacity, and timely effective policy response. With inflationary perils gathering on the horizon, the government will have to remain agile in deploying its limited resources if it hopes to sustain its economic revival and ascend the ranks of Asia's high-income powers.

Public & Expert Appraisal

The government's economic stewardship has earned plaudits from many quarters of the global expert community. The Asian Development Bank forecasts a solid 6% GDP expansion in 2024, with private estimates from banks like HSBC pitching even higher at 6.3%. Some metrics of long-run competitiveness, like innovation indexes, showed steady gains.

Yet, risks of setbacks remain palpable. Real estate indigestion, if poorly managed, could morph into a full-blown credit seizure. Natural disasters and climate insecurity loom ever larger. Perhaps most critically, skills deficits and institutional bottlenecks could perpetually impede lofty modernization drives.

Reining in inflation also poses a perennial challenge. Any protracted bout of price pressures could rapidly nullify the nation's hard-won cost advantages that have drawn manufacturers from across the globe. This would fray at an economic model still heavily reliant on low-value exports.

At the same time, ambitious green transition plans raise fears of premature deindustrialization if not carefully managed. While renewable energy was espoused as a priority, the immediate imperative was securing adequate fossil fuel supplies to power factories and grids.

This tension between future low-carbon visions and present-day realities encapsulates the policy tightropes Vietnam must navigate.

The Road Ahead

As the meeting's marathon length attested, burnishing the rally into a durable renaissance will be an epic undertaking requiring foresight and perseverance. For all its impressive economic strides, Vietnam still possesses a relatively slender base of skilled labor, productive capital and institutional quality.

Failure to decisively remediate these shortcomings could arrest the ascent into high-income status. A dearth of expertise in fields like semiconductors and digitalization would severely circumscribe ambitions of moving into high value-added industries.

Likewise, sclerotic bureaucracies and red tape could entangle efforts at attracting greenfield investment and diversifying away from low-margin activities.

Preventing such an outcome dictates bold reforms to liberate entrepreneurship and overhaul human capital pipelines, from re-tooling curriculums to incentivizing private job retraining schemes.

Officials appear cognizant of these imperatives, though actualizing them against inevitable political inertia will demand steadfast resolution.

Equally daunting is shepherding the environmental transition. While mouthing the appropriate sustainable platitudes, an instinct for self-preservation could see the leadership revert to carbon-intensive shortcuts if growth falters.

Fossil fuel dependence, wasteful urbanization and depleted ecosystems may prove to be the path of least resistance, punting ambitious decarbonization efforts down the road.

For a developing economy early in its ascent, such choices carry existential consequences. Deferring the piper's inevitable call of climate change and skills deprivation may provide ephemeral boosts, but only increase the eventual adjustment toll.

The reform momentum of 2024 thus demands to be not just sustained, but continually amplified lest the renaissance wither on the vine.

The government's policy warchest and political will are being severely tested. By resisting complacency and doubling down on supply-side dynamism, Vietnam could yet write itself an economic success story commensurate with its stratospheric ambitions.

But backsliding into old habits of environmental erosion and skills stagnation beckons the siren call of the middle-income trap. Astute zig-zagging between these two extremes may prove the ultimate test of Hanoi's mettle over the decade ahead.